Author: Omid Malekan, Professor at Columbia Business School, Crypto Writer

Original title: Beware the Lofty Promises of TradFi Firms Embracing Tokenization

Compiled and edited by: BitpushNews

Institutions have already entered the market and are slowly embracing the advantages of on-chain technology. This is undoubtedly a positive development for those who have long hoped for deeper involvement from traditional finance . My personal view remains that one day, all assets will become tokenized assets, and at that time, we will simply call them "assets."

It seems like there are exciting announcements every day from companies like DTCC (Depository & Clearing Corporation of the United States), Visa , SWIFT , Stripe , and PayPal. Judging from the press releases alone, these companies finally seem to be embracing real-time payments, 24/7 settlement, programmability, and atomic swaps.

But I don't buy it.

Or rather, I don't entirely believe it. Because none of them discussed the existential threat that "going on-chain" poses to their existing core business.

Make no mistake, there are clearly many bright people within these companies who believe in the benefits of permissionless blockchains. I've spoken directly with them and have great respect for them. The fact that they're allowed to express their beliefs so openly implies that senior management has already approved some level of substantial involvement. They wouldn't be doing this if they didn't see growth opportunities.

Intriguingly, none of these leaders discussed the risks that this new type of infrastructure, which is "unowned or uncontrolled," poses to their traditional businesses.

Public blockchains and permissionless networks represent a new primitive. They exist to break the monopoly or oligopolistic control of traditional financial giants over legacy infrastructure. It is logically impossible for networks like Ethereum to seize market share from existing centralized clearing and settlement networks without harming the giants who own and operate them.

Let's look at these examples:

1. DTCC (Depository & Clearing Corporation of the United States)

DTCC is preparing to tokenize the securities currently held within its subsidiaries. This is an important first step because, by law, most publicly traded U.S. stocks are recorded on its ledger.

However, the ultimate state of tokenization is direct issuance on-chain (Direct Issuance), at which point the world will no longer need clearing and settlement services provided by such companies. Technically, DTCC is the US equivalent of CSD, or "Centralized Securities Depository." In the more decentralized world of the future, services with "centralized" in their name will no longer be needed.

But I haven't heard DTCC leadership identify this risk.

2. SWIFT

SWIFT operates a secure communication system that is crucial for many types of payments, especially complex cross-border payments that need to be made through an opaque network of correspondent banks.

Stablecoins offer a completely different way to settle cross-border payments: lower costs, faster speeds, and greater security. They pose an existential threat to the correspondent banking model supported by SWIFT. In the world of cryptocurrency, payment itself is information. If all payments are moved on-chain, we will no longer need a 50-year-old "messenger."

However, I did not hear any panic within SWIFT regarding this "obsolescence".

3. Visa

Visa has a wide range of businesses, but at its core is operating a card network—a trusted telecommunications layer that delivers a "payment is coming" promise to merchants so they can immediately offer products or services.

Stablecoins replace this "promise" with "actual payment." Other Visa services may benefit from on-chain transactions, but bank cards are its lifeblood.

In its SEC filings, I haven't seen any further mention of the competitive risks associated with stablecoins, only a brief mention of them.

4. Stripe

Stripe provides an API that allows businesses to easily integrate various payment methods. Its pricing model is primarily based on bank cards, which present significant challenges in processing.

Stablecoins simplify everything and allow new competitors to enter various payment sectors.

Stripe's leadership talks at length about what they can gain from going on-chain, but never mentions what they might lose.

5. PayPal

PayPal operates multiple closed-loop payment networks, making money through interest income (float) and payment processing fees charged to merchants.

Stablecoins have the potential to eliminate all closed-loop systems because they offer all the advantages of closed-loop systems (instant payments, free P2P transfers, etc.) without any of their disadvantages (such as incompatibility like you using Zelle but your friend using Venmo). Stablecoins will also pay yields, which puts pricing pressure on all interest-income-based business models.

They also rarely talk about these risks.

Growth Opportunities and the "Innovator's Dilemma"

To reiterate: these companies can do many useful things by going blockchain, benefiting society and profiting themselves. The growth opportunities are clear. For example:

DTCC can charge a small fee for token services such as minting/burning and compliance management.

SWIFT's global network of bank directories and telecommunications systems facilitates easier, large-value wholesale payments.

Visa has a substantial non-card business, including Visa Direct, a real-time payment service that does not charge transaction fees and competes with other real-time payment services.

Stripe charges a flat 1.5% fee for accepting stablecoin payments, which means merchants pay less while Stripe gets a higher take rate, making it a win-win situation.

PayPal's stablecoins are occasionally used in DeFi, which was not possible in previous closed-loop schemes.

Assessing the gains and losses for these companies after they go blockchain is very complex. For example, although Visa has emphasized cross-border and real-time payment solutions in recent years, Visa Direct mostly transfers money to cards, and its widespread use will still increase transaction fees. Unless Visa develops a new solution that can directly compete with banks, its largest customers, stablecoin-based "push-to-wallet" services will not increase its transaction fee revenue.

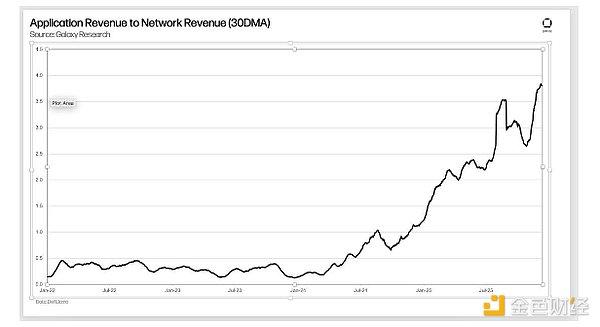

This complexity means these companies are unlikely to reap the benefits of cryptocurrency without making major mistakes. If the world goes entirely on-chain, their traditional businesses will inevitably be eroded, at least partially. The censorship resistance of networks like Ethereum invites endless competition, something some of these giants have never faced before.

Do we really believe these giants can handle the classic "innovator's dilemma"? Do we believe they can transform from a monopoly/oligopoly with annual revenues of hundreds of billions of dollars into an ordinary player in a crowded market? Do we believe they can outperform crypto natives who have no traditional baggage to protect?

I don't think so.

But why should I care about these things?

My skepticism stems in part from my experience working for or consulting with these companies. Their risk aversion is understandable. Their core businesses are run by veterans with deep expertise in the field, an experience that makes them skeptical of alternatives. I sympathize with their situation: if I had spent decades building a successful career on the old model, I would also be skeptical of new ones.

Regardless, these executives wield far more influence internally than their younger, more supportive colleagues; they will oppose substantial progress and may even sabotage it. This is driven by their self-interest. And to believe in cryptocurrency is to believe that self-interest trumps subjective intentions .

I've discussed this logic with some friends in the industry, and while they tend to agree, they're also curious why I care. As one insightful friend put it:

"The world's largest financial institutions are going blockchain, which is a huge achievement and something we could only dream of a few years ago. Who cares if they mess it up or just half-heartedly embrace it? Why not enjoy the present? If they mess it up, that's their problem, not ours."

Unfortunately, this will become our problem.

First of all, I want to clarify that my hesitation is not out of malice, nor is it an unrealistic demand for "purity" by revolutionaries.

My hesitation stems from my concerns about what these large institutions will demand of the crypto industry. I worry that they will wield the carrot of "mass adoption" and the stick of "regulatory capture" to force our industry to abandon the very characteristics that made open, permissionless networks so distinctive from the start.

This concern is not hypothetical; it is happening:

JPMorgan Chase is experimenting with permissioned tokenized deposits and money market funds, open only to "accredited investors" (i.e., millionaires). JPM is also using its vast lobbying power to prevent permissionless stablecoins from paying interest to ordinary people.

DTCC's embrace of tokenization focuses on permissioned "enterprise chains," which have virtually nothing to do with cryptocurrency. They are poorly designed traditional financial databases, riddled with useless cryptographic bloat. They lack censorship resistance and offer no guarantees of survival or security beyond off-chain legal agreements. They are essentially "DTCCs with added hashes."

Stripe is fully supporting Tempo , a permissioned blockchain in its initial phase. Transforming such a network into a permissionless one will be extremely difficult, especially given the $500 million strategic reserve involved and the large number of traditional financial partners who must protect their own moats.

I keep seeing more and more L1 and L2 business development teams weighing whether they should back some of their initial decentralized initiatives in order to appease Wall Street.

Crypto leaders who once scoffed at enterprise blockchain have suddenly changed their tune or become strangely silent as the new wave has risen.

Citadel Securities is lobbying to eradicate genuine DeFi while simultaneously supporting permissioned networks controlled by a consortium of companies. This is no coincidence; Citadel is one of the smartest companies in the world, and they know exactly what they're doing.

The risk that traditional financial giants might attempt to undermine the core value of crypto is amplified by the "suit-simp" phenomenon I mentioned a few weeks ago. Too many people in the crypto space either feel inferior to traditional finance, are too lazy to learn the unique aspects of blockchain, or have become apathetic and cynical because their assets are "locked in." These individuals are likely to betray the very foundation of the industry.

in conclusion

As the industry's cryptocurrency, engaging with these institutions and helping them integrate on-chain is crucial. We should do this with respect and understanding. The innovator's dilemma is real and difficult to overcome.

But when the real challenges arrive—and I guarantee they will—we must stand firm. Traditional finance needs to evolve to embrace cryptocurrency. Cryptocurrency should not regress to cater to them.

In short: Don't be a "simp" .

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush