Welcome to the US Crypto News Morning Briefing – a compilation of the most important crypto news for today.

Make yourself a cup of coffee, because today's Morning Briefing isn't just about interest rates. We'll be discussing financial leverage, Capital, and where the real rhythm of risky assets is being regulated as economic policies begin to diverge across the Pacific. When one central bank loosens (the US), the other tightens (Japan). This divergence is gradually creating new shifts in global liquidation – changes you won't easily spot from just a price chart or a candlestick.

Crypto news of the day: Japan raises interest rates, but the Fed cuts them – which will have a stronger impact?

Global financial markets are in a state of stalemate, amidst a rare moment of significant divergence in policy among major powers. In the US, the Federal Reserve (Fed) has begun lowering interest rates to support slowing economic growth . Meanwhile, the Bank of Japan (BOJ) has moved in the opposite direction: raising interest rates to their highest level in three decades.

The big question for investors now is no longer whether these moves matter, but which moves will be more decisive in impacting global liquidation , currencies, and the crypto market.

On December 19, 2025, the Bank of Japan (BOJ) raised its policy interest rate by 25 basis points to 0.75% , the highest level since 1995. This marked another step away from decades of ultra-loose monetary policy. Macroeconomic experts believe this move was not merely a minor adjustment.

Unlike the Fed's interest rate cuts – which are typically cyclical adjustments to support the economy – Japan's tightening is structural. For nearly 30 years, interest rates close to 0% in Japan have made it the world's cheapest source of leverage for loans.

Even small interest rate hikes in Japan have a significant impact, as they disrupt deeply ingrained Capital strategies in global financial markets.

The most noticeable impact was on the currency market. Despite Japan raising interest rates – a historic event – the yen initially weakened, as Governor Kazuo Ueda had yet to provide clear information on how he would continue tightening monetary policy in the future .

According to Reuters , the yen weakened as the Bank of Japan (BOJ) remained "unclear about its tightening policy." This suggests that future policy directions are key, not just interest rate hikes.

Many experts also argue that the main impact lies elsewhere: in yen carry trades, as highlighted in a recent US Crypto News article .

As Japanese bond yields rise and the US-Japan interest rate differential narrows, borrowing yen to invest in high-yielding positions becomes significantly more expensive.

This is also why the differences between Tokyo and Washington are so important:

- When the Fed lowers interest rates, the market is typically gradually supported by easing credit conditions.

- Conversely, when the BOJ raises interest rates, the cost of leverage increases, forcing investors to quickly adjust their positions.

Crypto markets typically react more sensitively than traditional assets to such changes. In previous BOJ tightening cycles, Bitcoin prices often plummeted 20–30% as liquidity tightened and yen carry trades were liquidated.

Therefore, Bitcoin's recent stability has drawn much attention. At the time of writing, BTC is trading around $88,035, up nearly 1% in the last 24 hours.

Bitcoin (BTC) price performance. Source: BeInCrypto

Bitcoin (BTC) price performance. Source: BeInCrypto“History shows that every time the BOJ tightens its monetary policy, it has led to a 20–30% drop in Bitcoin as yen carry trades are deactivated and the market runs out of liquidation. But this time, with interest rate hikes already anticipated by the market and BTC holding around $85,000–$87,000, this could be an opportunity for retail investors to buy on dips,” according to the Blueblock analyst.

However, Bitcoin's continued strong performance doesn't mean the risks in other areas of the market have ended. Altcoins are generally much more sensitive to liquidation, so if Japan continues to tighten its policies, they will continue to be significantly impacted .

In fact, BOJ leaders have not hesitated to affirm their readiness to continue tightening if wages and inflation in Japan remain stable. Experts at ING and Bloomberg both agree that the next interest rate hike may not happen immediately, but the trend is clear.

What does this mean for the global market? If the Fed cuts interest rates, it could help the market gradually recover. But Japan's departure from its "cheap money" policy will have a strong direct impact on the foundation of leveraged lending worldwide. If the BOJ continues this practice, the impact on liquidation, exchange rates, and even the crypto market could surpass the impact of the US's easing policy – at least in the short term.

Daily chart

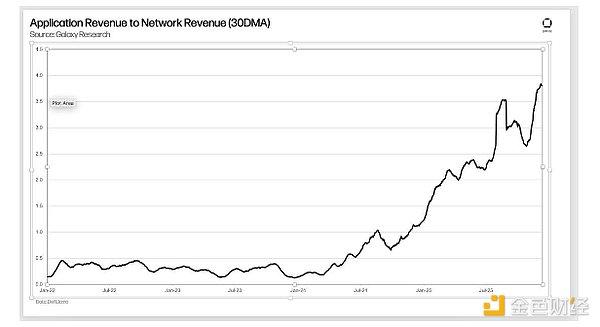

Federal Funds Rate (Fed Funds Rate) and Bank of Japan Policy Rate (BOJ Policy Rate)

Federal Funds Rate (Fed Funds Rate) and Bank of Japan Policy Rate (BOJ Policy Rate)Alpha byte size

Here's a summary of some of the top US crypto news you should keep an eye on today:

- What is a historically accurate indicator signaling for Bitcoin in December?

- ADA price drops 70% in 2025 — But two new sources of demand are emerging for Cardano.

- Is Toncoin undervalued? December data suggests a potential recovery.

- Selling pressure on XRP has decreased by 39%, but there is still a crucial price level that will determine its direction .

- Bitcoin whales have moved — but not as the market expected.

Market overview before the opening bell for crypto-related stocks.

| Company | Closing price on December 18th | Overview before opening |

| Strategy (MSTR) | 158.24 USD | 163.97 USD (+3.62%) |

| Coinbase (COIN) | 239.20 USD | 246.00 USD (+2.84%) |

| Galaxy Digital Holdings (GLXY) | 22.51 USD | 22.95 USD (+1.95%) |

| MARA Holdings (MARA) | 9.69 USD | 9.87 USD (+1.86%) |

| Riot Platforms (RIOT) | 13.38 USD | 13.73 USD (+2.62%) |

| Core Scientific (CORZ) | 14.56 USD | 15.04 USD (+3.30%) |