Ethereum continues to struggle to recover its price, consistently failing to close above $3,000. Despite occasional slight gains, ETH quickly declined again due to strong selling pressure.

Although price movements have not yet satisfied investors, network data shows that fundamental factors are strengthening, which could support a future recovery.

Investors holding Ethereum have not yet sold.

Ethereum leads the major cryptocurrencies in the number of wallets with active balances. The network currently has over 167.9 million active addresses holding ETH. In comparison, Bitcoin has only about 57.62 million wallets. Other large Capital cryptocurrencies also lag far behind these two networks.

This dominance demonstrates Ethereum's large user base and diverse applications. Activities such as decentralized finance, Non-Fungible Token , and smart contracts continue to hold significant appeal within the community. The high level of participation reflects confidence, a crucial factor in sustaining demand for ETH.

Want more information about Token like this? Sign up for the daily Crypto Newsletter compiled by editor Harsh Notariya here .

Data on the number of Ethereum wallets. Source: Santiment

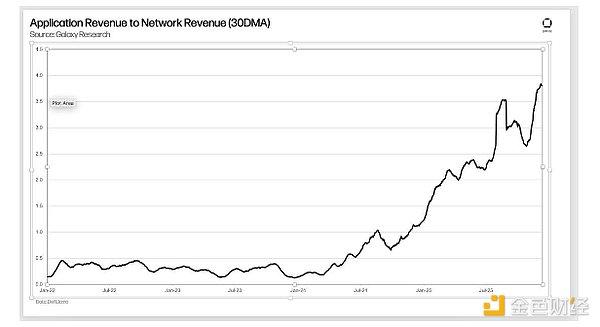

Data on the number of Ethereum wallets. Source: SantimentMacroeconomic indicators are also showing positive signs. The amount of ETH held on centralized exchanges is steadily decreasing. Since the beginning of the month, approximately 397,495 ETH has been withdrawn from exchanges, reducing the supply that can be sold immediately.

The withdrawal of ETH from exchanges indicates that many people are accumulating at the current price. The total value of ETH withdrawn currently stands at over $1.17 billion, demonstrating the confidence of long-term investors. As the balance of ETH on exchanges decreases, selling pressure diminishes, creating favorable conditions for a price recovery if buying pressure increases.

ETH balances on exchanges. Source: Glassnode

ETH balances on exchanges. Source: GlassnodeETH price could break through a key threshold.

At the time of writing, Ethereum is trading around $2,946 and remains below the psychological $3,000 mark. In recent weeks, ETH has consistently found good support around $2,762, indicating that buying pressure persists even during dips, despite market instability.

If the positive trends continue, ETH could attempt to break above the $3,000 mark again. If successful, the price could head towards the $3,131 region. If the upward momentum continues, ETH could reach $3,287, indicating confidence from both retail and institutional investors.

ETH price analysis. Source: TradingView

ETH price analysis. Source: TradingViewHowever, if selling pressure intensifies, the risk remains. If the price falls below $2,762, the recovery scenario will weaken. Losing this support zone could send ETH down to $2,681, setting a new four-week Dip and undermining positive arguments about network activity.