New economic data from the US is giving the market a clear but also rather complex signal. Inflationary pressures have eased, but consumers are still under considerable pressure.

For Bitcoin and the crypto market in general, this situation suggests a more favorable macroeconomic environment, although significant short-term volatility remains.

Why are inflation expectations more important than market sentiment?

According to the University of Michigan, U.S. consumer confidence edged up slightly to 52.9 in December 2023, a little higher than in November but still about 30% lower than the same period last year.

At the same time, inflation expectations continued to cool . Short-term expectations fell to 4.2%, while long-term expectations declined to 3.2%.

For the market, inflation expectations are far more important than consumer confidence levels.

Consumer confidence reflects how people feel about their personal finances and the economy. Inflation expectations, on the other hand, show how they think prices will change in the near future. Central banks are more interested in inflation expectations.

The downward trend in both short-term and long-term inflation expectations suggests that households believe upward price pressures are easing and will remain stable.

This supports the Federal Reserve's goal of controlling inflation without maintaining a tight monetary policy for too long.

This data follows the November CPI report, which showed inflation falling faster than expected. Both reports reinforce a common message: inflation is slowing down.

What does this mean for interest rates and liquidation?

Expectations of falling inflation will reduce the need to maintain high interest rates . The market often reacts by betting on sooner or more aggressive interest rate cuts, even when economic growth is slow.

This affects risky assets, including crypto, because:

- Low interest rates have led to a decrease in cash and bond yields.

- Real yields tend to go down.

- Financial conditions will gradually become more "lenient".

History shows that Bitcoin tends to react more strongly to liquidation conditions than to levels of confidence or economic growth.

Why weak confidence doesn't significantly impact the crypto market.

Low consumer confidence reflects pressure from the cost of living , rather than a drop in demand. People are still struggling, but are less concerned about further sharp price increases.

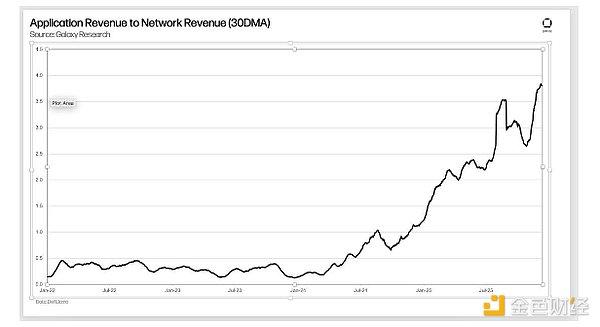

The crypto market doesn't depend on consumer spending like stocks. Instead, crypto prices react strongly to:

- Interest rate expectations

- The strength of the US dollar

- Global liquidation situation

Therefore, expectations of lower inflation remain favorable for Bitcoin, even if consumer confidence has not yet recovered.

Why is volatility likely to continue?

This context favors risky assets that appreciate in value over time, but not smoothly.

Weak confidence means growth remains fragile. The market will be more sensitive to data releases, short-term Capital flow fluctuations, and investor sentiment. For example, after the CPI report, even with positive data, the market could still experience a sharp correction due to high leverage.

With Bitcoin, this often leads to:

- React strongly to macroeconomic news.

- Prices fluctuate wildly, going up and down.

- The upward trend is driven primarily by liquidation rather than strong confidence.

Looking ahead to January 2026

Overall, the data suggests that the macroeconomic environment is improving for the crypto market as we head into early 2026. Inflationary pressures are easing, policies are gradually becoming more relaxed, and liquidation conditions are also more favorable.

However, weak confidence explains why the market remains highly volatile and susceptible to sudden sell-offs.

The key takeaway is: the macroeconomic environment is improving for Bitcoin, but price volatility will depend heavily on cash flow, leverage levels, and timing, rather than just pure belief or optimism.