Recently, the American online brokerage giant Robinhood announced the launch of "stock tokens" linked to the equity of top unlisted companies like OpenAI and SpaceX for European users, once again pushing the cutting-edge topic of real-world asset (RWA) tokenization to the forefront. However, OpenAI quickly issued an official statement, clearly stating that it has no association with the tokens issued by Robinhood and warning that "these tokens do not represent the company's actual equity".

This incident not only reveals the profound contradiction between financial innovation and traditional equity management but also provides a thought-provoking case for global regulators and market participants. The crypto legal team will analyze the impact and significance of this case in conjunction with RWA-related explorations.

(Image source: 36 Kr)

I. Event Background

1. What is Robinhood?

Fundamentally, we need to know what Robinhood is. Robinhood Markets, Inc. is an American financial services enterprise headquartered in Menlo Park, California. The company is known for providing a stock app and website primarily targeting retail investors. Robinhood offers its online services completely free of charge. As a fintech company, Robinhood is committed to innovating financial products and service models.

Robinhood primarily offers trading of US-listed stocks, exchange-traded funds, related options, and crypto assets, as well as cash management. Its positioning is to provide zero-commission trading services for US retail investors in stocks, options, ETFs, crypto assets, and other assets, primarily generating revenue through interest on customer cash balances, margin interest, and selling order flow to high-frequency trading institutions.

It has established a European center in Lithuania and formed Robinhood Europe UAB. According to public information, this entity has obtained a Class A financial brokerage license and a crypto asset service provider license from the Lithuanian Central Bank, allowing it to provide crypto asset custody, management, and trading services in Lithuania and the entire European Economic Area.

2. Event Summary

Specifically, this event refers to: At the European Crypto Finance Summit in Cannes, Robinhood announced the launch of a "stock token" product for EU and European Economic Area users, allowing investors to trade over 200 US stocks and ETFs 24/7 using blockchain technology. Most notably, it tokenized the stocks of unlisted companies OpenAI and SpaceX, airdropping 5 euros worth of OpenAI and SpaceX tokens to EU users as a promotion. Influenced by this news, Robinhood's stock price rose significantly.

However, on July 3rd in the early morning, OpenAI issued a statement on its official social media, clearly stating that these OpenAI tokens are not OpenAI's equity, the company has not collaborated with Robinhood or participated in this matter, and does not endorse it. It emphasized that any transfer of OpenAI equity requires company approval, which has never been granted.

What are these OpenAI tokens...

Are the statements from Robinhood and OpenAI contradictory...

What are the operational mode and legal basis for Robinhood issuing OpenAI and SpaceX tokens...

How does this event differ from traditional RWA projects...

The crypto legal team will provide a detailed explanation.

(Translation continues in the same manner for the rest of the text)

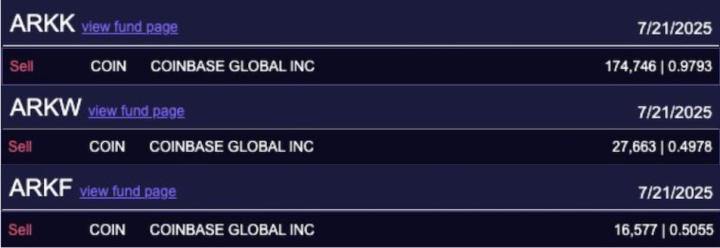

(Image source: Galoy Research)

4. Regulatory Bodies

Robinhood's issuance of OpenAI tokens currently requires regulation from the Lithuanian Central Bank and the European Union. Robinhood has obtained a Class A financial brokerage license from the Lithuanian Central Bank and a crypto asset service provider license from the EU, with the Lithuanian Central Bank serving as its lead regulatory authority in the EU. Regarding the issuance of OpenAI tokens, the Lithuanian Central Bank has initiated an investigation, requesting Robinhood to provide details about the token's structure, market promotion, and consumer communication to assess its legality and compliance.

Robinhood's stock tokens are issued under the Markets in Financial Instruments Directive II (MiFID II) as derivatives. As trading volume increases, it may also need to be regulated by ESMA (European Securities and Markets Authority), and Robinhood must ensure compliance with prospectus disclosure requirements. Currently, the token is only open to European citizens and not to US citizens. If it enters the US market in the future, it may be subject to SEC (Securities and Exchange Commission) regulation.

Robinhood can issue OpenAI tokens in Europe mainly because:

- Compared to the strict "accredited investor" system in the US, the EU has a relatively lower threshold for retail investors to participate in complex financial product trading.

- Robinhood's stock tokens can be issued under MiFID II as derivatives, with underlying assets custodied by US-licensed institutions, which to some extent meets the EU's requirements for financial product compliance.

- Robinhood uses its application to provide services to retail investors in the EU, and its crypto application in Europe has transformed into a more comprehensive investment platform.

However, for institutions holding OpenAI stocks, if one institution adopts a tokenization operation, the interests of the other 19 institutions will be immediately damaged. Holding equal shares of stocks, some institutions can implement such operations while others cannot, and the core issue is that interests are unilaterally occupied, which will make subsequent related operations difficult to obtain cooperation from other institutions.

For more institutions, if tokenized exit becomes a regular mode, more investors will focus on stocks in the tokenization market, which will further intensify stock price volatility and transform the investment market into a place dominated by institutions with stronger speculative attributes. From the perspective of compliance practitioners, this model faces huge challenges. Tokens have borderless characteristics, while listing rules have clear national boundary restrictions, which will impact various global markets.

Secondly, the rigorous architecture of the traditional financial system relies on company law, fund law, securities law, investor protection mechanisms, and exchange rules. Tokenization-related operations have many legal disputes, such as tokens can be infinitely split, while stocks cannot achieve this characteristic; the registration system and internal filing system of stocks have clear legal basis, and violations can be held accountable through internal mechanisms. However, tokens' free circulation on the chain is difficult to supervise and lacks the motivation for active supervision, which also constitutes significant damage to shareholders' interests. Therefore, in essence, Robinhood's issuance of OpenAI tokens may have added an investment target to the Web3 field, but it has not produced direct value for the stock market.

Although "stock tokenization" has drawbacks in some aspects and brings new challenges to investors, as an innovation in the Web3 field, its existence has a certain rationality. Web3 itself is a field that constantly breaks through traditional logic, and the financial innovation exploration reflected in this event has certain positive significance. However, for practitioners in the traditional financial industry, the impact is quite strong. Therefore, whether investors or other brokers and enterprises interested in trying "stock tokenization", they should treat this matter cautiously.

This represents only the author's personal opinion and does not constitute legal consultation or legal advice for specific matters.