1. Introduction

As the price of Bitcoin breaks through a new high of $120,000, the bull market "altcoin season" is brewing and heating up. The so-called altcoin season refers to a period of frenzy in the crypto market when non-Bitcoin assets (Altcoin) collectively outperform Bitcoin. During this period, the prices of various Altcoin skyrocket and investor sentiment is high. However, the background of this round of bull market is different from the past. For example, global macro interest rates are still high, the crypto regulatory environment is becoming more relaxed, institutional funds continue to enter the market through ETFs, companies have laid out crypto asset reserves and treasury strategies, and meme coins are rampant, which makes this round of Altcoin market present new characteristics.

This article will analyze the new trends and differences of the 2025 altcoin season by reviewing the characteristics and rules of the rotation of the altcoin season in previous bull markets, combined with the current market macro background and capital flow characteristics. At the same time, it will dismantle the phase division and rhythm characteristics of the Altcoin rotation, judge the current position, and take stock of the sectors and potential assets that are worth paying attention to. It will also give ordinary investors participation strategy suggestions in the altcoin season, helping everyone to stay rational in the market boom, seize opportunities and avoid unnecessary risks.

II. Historical Review: The Copycat Season and Sector Rotation in the Bull Market

The concept of altcoin season really entered the mainstream vision around 2017. In the early days of the crypto market, Bitcoin dominated, and other "altcoin" currencies were relatively small. But as Bitcoin climbed to the $3,000 and $10,000 mark in 2017, funds began to overflow from Bitcoin and poured into Ethereum and various ICO tokens, triggering the first large-scale Altcoin craze in history. The period from Q4 2017 to the beginning of 2018 is often regarded as the first typical "altcoin season", and investors were surprised to find that almost any token was soaring. At that time, several significant phenomena appeared in the market:

- Fund rotation: After a period of sharp rise, Bitcoin began to stagnate and go sideways. Smart money gradually took profits from BTC and looked for targets with higher risks and higher returns, flowing into ETH, mainstream public chains, large-cap Altcoin, and finally various small-cap tokens and MEME coins. During this process, Bitcoin's market share declined significantly - in February 2017, BTC's market share was as high as 80%, and by January 2018 it had fallen below 32%. This rapid decline in BTC's share is usually regarded as an important sign of the start of the altcoin season.

- Price performance: Altcoin as a whole have increased much more than Bitcoin. In the ICO boom of 2017, Bitcoin rose from less than $1,000 at the beginning of the year to nearly $20,000 at the end of the year, an increase of about 20 times; but during the same period, Ethereum rose from around $10 to a maximum of $1,400, an increase of more than 100 times, and some Altcoin such as XRP even rose hundreds of times. According to CoinMarketCap, during the altcoin season in early 2021, many large Altcoin rose several times or even ten times in 90 days. Overall, more than 75% of the top 50 Altcoin in the season outperformed Bitcoin, which is a typical signal of the altcoin season. For example, from February to May 2021, the average increase of large-cap Altcoin reached 174%, while Bitcoin rose only 2% during the same period.

- Sentiment and trading enthusiasm: The market is filled with FOMO sentiment, and people are rushing to buy any coin. Social media is full of discussions such as "XX coin has doubled again, am I buying too late?" Telegram groups and Discord channels are full of people sharing screenshots of getting rich every day, and new investors are rushing into the market. Experienced KOLs frequently shill, and centralized exchanges are competing to list new coins. It is normal for small coins to double in price as soon as they are listed. The market sentiment index is hovering in the extremely greedy range, and the speculative craze is getting higher and higher.

- Sector rotation: Although it seems that all sectors are rising at the peak of the craze, a deeper observation can still reveal the internal sector rotation rhythm. The hot spot in 2017 was first the ICO concept (Ethereum led the ERC20 token craze), followed by outstanding performance of platform coins/public chains (EOS, NEO, etc.), and the market of privacy coins (such as Monero and Dash) was also interspersed during this period. In the bull market of 2021, the sector rotation is more distinct: the DeFi craze in the summer of 2020 sounded the prelude to the altcoin market, followed by the Layer1 public chain war (the rise of BSC ecology, Solana, etc.) and NFT craze in early 2021, followed by Meme coins (Dogecoin DOGE and SHIB skyrocketed under the leadership of Musk) and the Metaverse/GameFi craze at the end of the year. Each sub-sector tends to lead the market for a period of time, and then the rise slows down, and the market focus shifts to new themes. The duration of the overall altcoin season is often a window period of about several months.

Although the altcoin season has brought an amazing wealth effect, it is often also a signal that the entire bull market cycle is nearing its end. Historical data shows that whenever Altcoin soar on a large scale and the whole nation is intoxicated by the carnival of "small coins doubling tenfold", new funds are often close to exhaustion, and the market is in an extremely excited but fragile state. Once the buying pressure cannot keep up, the bubble will burst very quickly. For example, after the Altcoin peaked in January 2018, its market value was halved in just a few weeks, and a large number of investors were trapped on the top of the mountain before they could withdraw. Similarly, the plunge in May 2021 also proved that the risks increased dramatically after the madness. The altcoin season has a chance to appear in every round of bull market, but it is often accompanied by huge fluctuations and risks. Investors must seize opportunities and be alert to the arrival of market turning points.

3. The macro background of the 2025 copycat season: differences and similarities between capital flow characteristics and past

In July 2025, the Altcoin market showed a general rise: CryptoBubbles data showed that the monthly increase of many mainstream Altcoin was between 20% and 200%, presenting a "green sea", indicating that funds are flowing from Bitcoin to the broader crypto asset market.

Source: https://cryptobubbles.net/

In this cycle, the market environment and the Altcoin market have undergone subtle changes. On the one hand, after the fourth Bitcoin block reward halving (April 2024), the market entered an upward cycle as expected, but the macroeconomic environment is quite different from the previous bull market: the world's major central banks have experienced tightening in 2022-2023, and high interest rate policies have not yet completely turned to easing. In other words, the launch of this round of crypto bull market did not occur against the backdrop of "flooding liquidity", but was more like a market driven by the restructuring of stock funds and expectations for the future. This is reflected in the emergence of new features in the source of capital inflows:

- Stablecoins become the main carrier of incremental funds: The typical pattern of the past altcoin season is that the surge in Bitcoin has led to a huge increase in the book wealth of coin holders, and part of the profits are then converted into funds for buying Altcoin. The difference in this round is that funds no longer flow into the Altcoin market mainly through the sale of BTC, but are directly injected by stablecoins. This means that both retail investors and institutions are more inclined to directly purchase Altcoin with stablecoins exchanged for fiat currencies. On the one hand, this phenomenon reflects the maturity of the stablecoin infrastructure, and on the other hand, it also shows that a considerable proportion of new capital in this round of market is bypassing BTC and directly entering other tracks. Bitcoin is no longer the only entrance for funds, and stablecoins are taking on the role of "reservoir".

- Institutional funds and ETF effect: Another obvious difference in this round of bull market is the increased participation of traditional institutions. With the approval of Bitcoin and Ethereum spot ETFs in early 2025, institutional funds have flowed in significantly. These funds are largely diverted from traditional stocks, gold and other fields, mainly focusing on Bitcoin and mainstream assets, and not chasing high-risk small currencies. It can be said that the institutional bull market and the retail bull market have been somewhat split in this round: Bitcoin continues to attract money driven by ETFs, which has formed a capital siphoning effect on Altcoin. This is in contrast to the previous bull market - in the past, BTC rose and brought ETH and altcoins together, but this time BTC has attracted market attention more independently due to the entry of institutions.

- Diversion of the meme coin wave: If institutional funds prefer Bitcoin, then in the more fanatical retail speculation field, a unique phenomenon has also appeared in this round: low-market-cap meme coins on the chain have attracted a large amount of speculative funds. The launch and rise of the Meme one-click coin issuance platform represented by Pump.fun have provided the market with a steady stream of speculative themes. These meme coins usually lack fundamental support, but they attract a large number of followers due to the myth of early entrants making huge profits. As a result, speculative funds that should have flowed to mainstream copycat projects have been massively diverted to ultra-small-market-cap meme coins on the chain. Some early participants have doubled their wealth several times or even dozens of times in a few days, but for latecomers, most of these meme coins have been followed by a 70% to 90% deep halving after the surge, and liquidity has quickly dried up, becoming a trap to strangle retail investors' wealth. This drastic "internal capital consumption" was not obvious in previous copycat seasons. It can be said that in this round of altcoin market, retail investors’ speculative enthusiasm was partially diverted by the meme sector, which in turn caused a financial dilution for mainstream Altcoin.

- Narrative outbreak and political factors: Macro narratives and political events have also had a direct impact on the crypto market, which is a rare feature of previous copycat seasons. US President Trump actively promotes crypto-friendly policies, the Trump Group has made a high-profile foray into the crypto field, established the World Liberty Financial platform and issued $WLFI tokens, and promoted the inclusion of Bitcoin in the US national strategic reserve. These events have detonated the so-called "political narrative" sector, leading to a short-term surge in related tokens such as MAGA and TRUMP. At the same time, the US policy environment and interest rate environment have also shown signs of loosening, further stimulating the market's imagination. The intervention of political forces has not only brought short-term hot spots, but also elevated the crypto issue to a national strategic level, which has not occurred in previous rounds of bull markets. In addition, hot spots from the technology trend such as "AI narrative" and "Web3 social" have also emerged in this round, and they have developed in parallel with each other, resulting in a high degree of fragmentation of market hot spots.

Combining the above factors, it can be found that the 2025 alt season presents a different ecology from the past: funds no longer push up all Altcoin in unison, but quickly rotate between different sectors, and hot spots rise and fall. Each sector has gone out of the "fighting on its own" market according to its own subject matter strength and funding background. In the crypto market, AI Agents, SocialFi, Politifi, SciFi, Ethereum Restaking, DePIN, RWA and other "small climaxes" have emerged one after another. Each sector has attracted a short-term influx of funds, and then quickly receded. Under this rhythm, the traditional picture of "Altcoin rise and fall together" is no longer obvious. The "alt season" is no longer a period of synchronous prosperity for all Altcoin, but more like a series of narrative-driven rotations.

4. The stages and rhythm of Altcoin rotation: Which stage are we in now?

Although the current cottage market has evolved, the staged nature of capital rotation still exists. Combining historical rules and the current market, the cottage season often goes through a rotation process from "big" to "small", which can be roughly divided into four stages:

- Phase 1 – Bitcoin Dominance (AltSeason Index: 0-25):

At this stage, the entire market is driven by Bitcoin. Funds first poured into BTC, pushing up BTC prices and market capitalization. At this time, the altcoin index is usually at a low level (0-25 range), which means that the market is obviously dominated by BTC. Although Altcoin may rise with the market, they generally underperform BTC. This pattern is common in the early stages of a bull market or recovery period. Since the beginning of 2025, Bitcoin has led the market for most of the time, and BTC.D once rose to a multi-year high of more than 65%. At this stage, the mentality of investors is usually "holding coins for price increases and holding on to BTC core assets."

- Phase 2 – Ethereum and large altcoins launch (Altcoin Season Index: 25-50):

Next, when Bitcoin's rise was too large and began to go sideways or slow down, the market saw a "capital overflow effect". Smart money partially took profits from BTC and turned to large currencies such as Ethereum that followed closely behind. The typical signal is that the ETH/BTC exchange rate began to rise, and Ethereum's rise outperformed Bitcoin. The market began to discuss the possibility of "Ethereum surpassing Bitcoin". Coupled with the positive factors such as the increase in DApp activity on the Ethereum network, ETH received excessive attention. In the late stage of Phase 2, funds also began to flow gently to other high-market-cap Altcoin, and some mainstream coins ranked in the top 20-30 by market value (such as BNB, SOL, ADA, etc.) will have a significant catch-up rally. The current market characteristics show that we are in the late stage of this stage (Altcoin Season Index is close to 50): Ethereum has an advantage over Bitcoin, and the market capital flow is more diversified.

- Phase 3 – Large-cap Altcoin rise across the board (Alt Season Index: 50-75):

When Ethereum has seen a large increase and the market risk appetite has increased, funds have further flowed into other large-cap Altcoin. At this stage, the mainstream currencies with the highest market capitalization (L1 public chain, platform coins, etc.) tend to rise together, with considerable and sustainable gains, and market sentiment is optimistic but not completely crazy. The altcoin season index is at a medium-high level (50-75 range) at this stage, which means that more than half of the mainstream Altcoin have begun to outperform Bitcoin. At this time, rational investors will gradually consider which coins have risen too much and should start to cash in some profits.

- Phase 4 – Small market capitalization and sentiment carnival (Alt Season Index: 75+):

This is the peak and the end of the altcoin season. During this stage, regardless of the fundamentals of the project, almost all tokens of different market capitalizations are soaring, and the market is filled with extreme excitement and irrational emotions. The altcoin season index is in an extremely high value range (75-100), indicating that most Altcoin have outperformed Bitcoin across the board, and the market is in an irrational uptrend. Typical signs include: emotional vanes such as Dogecoin have a short-term surge; the media use words full of "frenzy" and "feast"; Bitcoin's market share falls below 50% or even below 45%. However, this stage is often also the period with the highest risks and the largest bubbles. When the altcoin season index exceeds 75 and continues to rise, investors need to be highly vigilant and gradually reduce their positions to avoid risks.

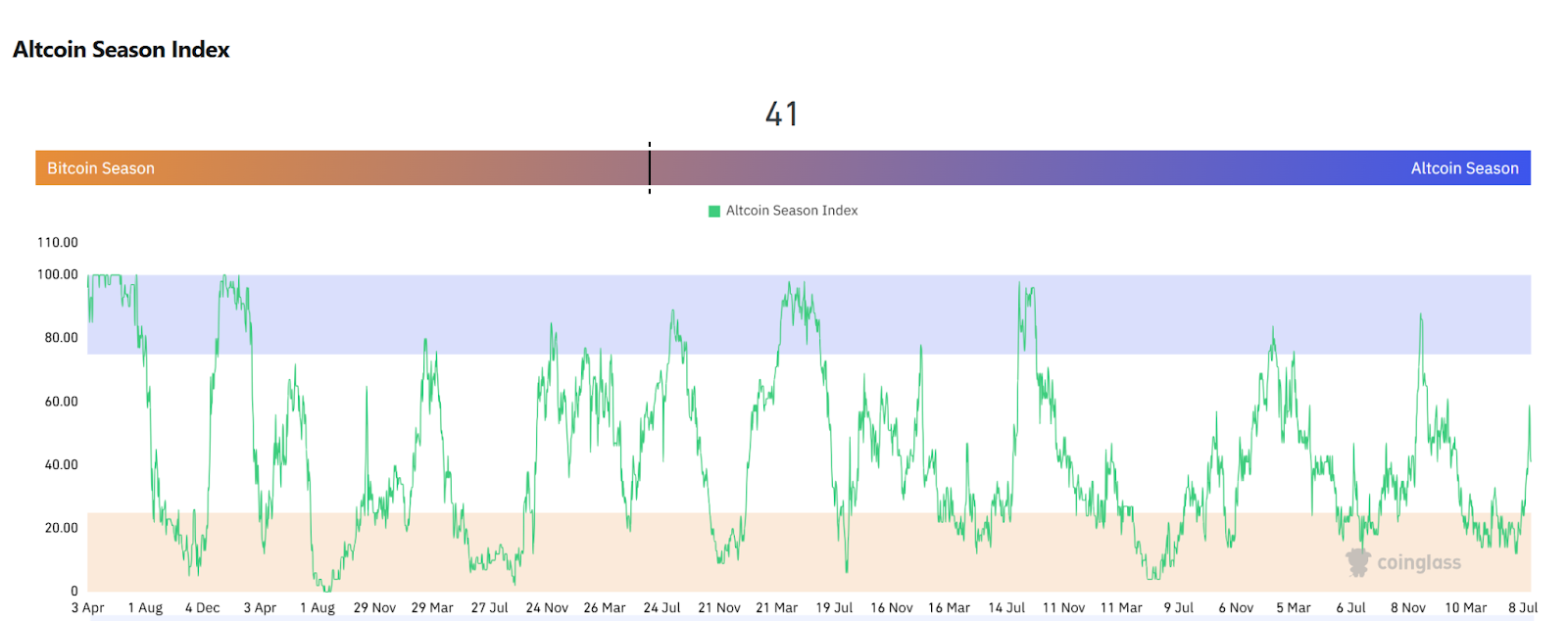

Source: https://www.coinglass.com/pro/i/alt-coin-season

Market characteristics since July 2025 indicate that the altcoin season has started but has not yet entered the most frenetic stage. Specifically, Bitcoin took the lead in rising sharply in the first half of the year and consolidated its market share at a high level of 60%+, and the first stage was basically completed; recently ETH has begun to outperform BTC, indicating that the second stage has begun. Led by Ethereum, large-cap altcoins (SOL, ADA, etc.) have also shown a significant upward trend, which is a signal of transition to the third stage. However, the comprehensive small-coin carnival (the fourth stage) does not seem to have arrived yet: the current Altcoin Season index is around 40-50, which has not reached an extreme value; the proportion of Bitcoin has only fallen from a high of about 65% to just over 60%, and there has not been a cliff-like plunge. The activity of some sentiment indicators, such as meme coins, has increased, but it is still far from the real "frenzy". Therefore, the current stage is roughly equivalent to the end of stage 2 to the beginning of stage 3, that is, the period when large-cap Altcoin dominate the rise and spread to small and medium-sized market capitalizations.

5. Analysis of sectors and currencies worth paying attention to at present

Although this round of altcoin season presents the characteristics of "fast sector rotation and few unified rising markets", this does not mean that there are no investment opportunities. Correctly grasping hot sectors and high-quality currencies is still the key to obtaining excess returns. In the highly fragmented narrative market, investors need to be discerning and distinguish which tracks are truly driven by funds and supported by fundamentals, and which are purely hype and short-lived. In this section, we combine market trends and research institutions' views to take stock of several major sectors and related currencies that are currently worthy of attention.

- RWA sector: The RWA concept is one of the most eye-catching sectors in this round of market. According to statistics, the RWA protocol token has achieved an average increase of more than 15 times in this cycle, far exceeding most other sectors. The reason why the RWA sector is strong is that its narrative fits the needs of institutions - tokenizing real-world assets (such as bonds, bills, and real estate rights) on the chain is seen as a bridge between traditional financial markets and crypto markets. When paying attention to the RWA sector, it is recommended to give priority to projects that are already large and have been tested by the bear market (such as ONDO and SKY), because they have more advantages in institutional participation and risk control.

- AI sector: The concept of AI is also very popular in the Web3 field. The combination of AI and blockchain includes: using blockchain to ensure the credibility of AI data sources and model training, using token mechanisms to incentivize AI computing power or data contributions, and creating so-called autonomous AI agents (AI Agents) to autonomously perform tasks on the chain. The "AI Agent" craze that emerged earlier this year is the product of this idea. For the AI sector, investors should be wary of many projects that lack a clear profit model and rely solely on hot hype. But at the same time, there are also some high-quality projects with technical accumulation or cooperation backgrounds with large companies that are worth paying attention to. For example, Bittensor (TAO) aims to build a decentralized machine learning network based on blockchain. Fetch.ai, Ocean Protocol and SingularityNET merged in July 2024 to form the Artificial Super Intelligence Alliance (ASI). According to the plan, the first phase will temporarily merge AGIX and OCEAN tokens into FET tokens, and then these FET tokens will be uniformly converted to ASI tokens. Virtuals Protocol (VIRTUAL) combines blockchain technology with AI to break through the current limitations in the deployment, monetization and interaction of AI agents.

- DePIN sector: DePIN (Decentralized Physical Infrastructure Network) refers to projects that use crypto incentives to build infrastructure in the physical world. For example, Helium uses token incentives to build a distributed IoT hotspot network, Pollen Mobile attempts to build a decentralized cellular network, and Filecoin uses blockchain to incentivize distributed storage. Institutional reports regard DePIN as one of the important new themes in 2024, believing that it is expected to expand the incentive mechanism of cryptocurrency to the physical field. DePIN projects attract industrial capital and cutting-edge technology players, so they often have independent market trends in bull markets. Helium created a hot spot in 2021, and Filecoin's decentralized storage has also attracted renewed attention recently. If infrastructure tokens (such as FIL, HNT, etc.) have a long period of stagnation and solid fundamentals, then once the market preference shifts from pure financial speculation to technology landing, these currencies may experience valuation repair. Allocating the DePIN sector is suitable for patient investors to hold in the medium and long term, but positions must be controlled because such projects have high technical and policy risks (involving spectrum resources, physical equipment deployment, etc.).

- Layer2 and modular blockchain sector: Tokens in the Layer2 track (such as ARB, OP) are expected to benefit from increased on-chain activities and user migration in the bull market, and have become one of the new "large-cap copycats". For example, Robinhood announced the launch of tokenized stock trading and launched a Layer2 blockchain dedicated to RWA based on Arbitrum. In particular, the concept of modular blockchain is also worth noting, such as the modular blockchain architecture proposed by Celestia, which separates the execution layer from the data layer and improves network efficiency. It is hailed as a new paradigm in blockchain technology. Once the feasibility of this type of underlying technology direction is verified, the relevant tokens (such as Celestia's TIA) have the potential to be sought after by funds.

- DeFi 2.0 and new financial native sectors: Although the DeFi sector in this bull market seems much more low-key compared to the DeFi craze in 2020, after the plunge and liquidation in 2022, the valuation of leading DeFi projects has shrunk significantly. For example, the market value of Uniswap, Aave, Compound, etc. has fallen by more than 70% compared to the peak period. If the entire market continues to warm up and a large amount of funds re-flow into on-chain activities, then these DeFi protocols with real income and user base are likely to usher in a revaluation. After Ethereum Shanghai upgraded and opened up staking withdrawals, LSD and Restaking ecology derived new income strategies and protocols (such as EigenLayer and Pendle, etc.). When investing in the DeFi sector, you can pay attention to several indicators: the growth of the protocol's income and handling fees, changes in the locked volume (TVL), community governance and token repurchase and destruction dynamics, etc.

- Meme coin sector: Meme is an eternal topic in the crypto market. In the late stage of the bull market, various meme coins emerge like mushrooms after rain. For example, BONK, PENGU, USELESS and others have become popular in this round, not to mention "evergreens" such as Doge, SHIB, and PEPE. Investing in meme coins is more like participating in a social psychological experiment - the rise and fall often depends entirely on market sentiment and stories, rather than any intrinsic value. As mentioned above, many on-chain meme coins in this round soared and then plummeted by 70% to 80%, verifying their game nature of passing the parcel. If investors are interested in participating, they must also be prepared for risks: small positions, strict stop-profit and stop-loss settings, and treat meme coins as entertainment or condiments. Don't go all in, otherwise you may become the last person to take over.

6. Participation strategies for ordinary investors: rationally manage the copycat season

Although the altcoin season is exciting, for ordinary investors, how to stay calm in the frenzy and avoid risks in opportunities is the key to long-term success. In this section, we provide suggestions for general investors from three aspects: risk management, position control, and phased operations, to help everyone participate in the altcoin season with ease.

1. Risk awareness takes precedence over profit aspirations: When entering the altcoin season, we must first realize that risks coexist with opportunities. History has repeatedly proved that the surge in Altcoin is often accompanied by violent fluctuations, and the ones with the largest gains often fall the most. Therefore, we must be mentally prepared to welcome a 30%, 50% or even larger retracement at any time. When you hear people around you are talking about a certain coin rising tenfold, it is very likely that you will be close to the top if you rush in. Remind yourself in time: "The market is always in the 28th law. Others become 20% of the money-making winners, and you are likely to fall into the 80% of the takers." Only by keeping the risk string tight at all times can we stay sober in the frenzy.

2. Position control and diversification: Position management is particularly important for highly volatile Altcoin. Avoid investing all your money in a single Altcoin. No matter how optimistic you are about a project, you must guard against black swans and sudden market reversals. A reasonable approach is to divide the investment funds into several parts: the main positions are allocated to relatively stable assets (such as BTC, ETH or the top ten currencies by market value) to ensure that even if the altcoins fall back across the board, your portfolio still has a certain degree of resistance to declines; another small part of the positions is used to gamble on small currencies or hot topics with high risks and high returns. For example, you can set no more than 20%-30% of the total funds for altcoin speculation, and the rest remains in core assets or stablecoins. In this way, even if the judgment is wrong, the loss is within a controllable range. In addition, the altcoin positions should also be dispersed to multiple sectors and currencies, and not put all your eggs in one basket.

3. Follow the trend and pay attention to the rhythm switching: The operation of the altcoin season needs to follow the market rhythm, rather than fighting against the trend. In stage 1-2 (Bitcoin and ETH lead the rise), you might as well take more BTC/ETH and change coins less frequently, because the strong will always be strong at this time, and rashly switching to weak coins will lose profits. When entering stage 3-4 and many altcoins are launched, you can gradually roll over BTC profits to strong altcoins, but be sure to pay close attention to the market trend. For example, when you find that various small-cap coins are soaring and novices are entering the market, it may mean that it is nearing the end and you should consider reducing your risk exposure. At the same time, you can refer to some objective indicators to prompt the rhythm: the Altcoin Season Index is a useful tool. When it rises to an extremely high level (such as >75) and continues, you must be highly alert to the overheating of the altcoin market. In addition, pay attention to signals such as Bitcoin's share falling below a key level (such as 50%) and irrational carnival remarks in the media.

4. Set goals and stop losses, and execute trading plans: Discipline is particularly important in the high-speed market of the altcoin season. It is recommended to think about the conditions and plans for selling before buying any Altcoin. For example, you can set a series of rules for yourself: "If a certain coin rises by +50% or +100%, sell part of it in batches"; "If it falls by more than -20%, stop loss and leave the market to prevent deep traps" and so on. Setting these rules and strictly enforcing them can prevent emotions from influencing decision-making. Especially in small coin investment, stop loss must be set, because small coins may plummet continuously if they step on the wrong rhythm. In terms of profit-taking, it is better to adopt a gradual profit-taking strategy, cashing out in batches at high prices during the rise, rather than trying to wait for the absolute peak and then sell all at once - it has been proven that it is almost impossible to sell at the highest price. Batch settlement can not only lock in part of the profit, but also allow the remaining positions to fight for the final sprint, and the psychological pressure is much less.

5. Stay rational and don't be dominated by greed and fear: The cottage season tests the greed and fear of human nature. When the coin you hold reaches the daily limit, it is easy to be overconfident, overweight or even borrow money to increase leverage, but this often contains the greatest risk; on the contrary, when the market plummets, it is easy to lose control of emotions and sell at a loss, but it may be sold at an irrational bottom. Therefore, investors should always remind themselves of discipline. If you feel that you can't stay rational under high volatility, you might as well reduce the frequency of operations or reduce your position, or even choose to wait and see. As the old saying goes: "There will always be the next opportunity in the market, first make sure you are alive." Never bet everything on one throw because of greed, and don't lose judgment because of panic.

Conclusion

The alt season in the crypto market is not only a stage for ordinary investors to achieve wealth leap, but also a Shura field where greed and fear are intertwined. Looking back at previous bull markets, we have witnessed the cyclical law of the rotation of the alt market, and also witnessed countless legends and bubbles. Similarly, in this round of market in 2025, although the alt season presents a more fragmented and faster rotation trend, its core driving force remains: human risk preference and pursuit of new opportunities. For ordinary investors, while embracing the opportunities of the alt season, they must also respect the market and the risks. Opportunities are always reserved for those who are prepared. I hope everyone can not only reap joy in this alt season drama, but also get out of it unscathed.

about Us

As the core investment and research center of the Hotcoin ecosystem, Hotcoin Research focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a three-in-one service system of "trend analysis + value mining + real-time tracking". Through in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluation of potential projects, and 24-hour market volatility monitoring, combined with the weekly "Hotcoin Selection" strategy live broadcast and "Blockchain Today's Headlines" daily news delivery, we provide investors at different levels with accurate market interpretation and practical strategies. Relying on cutting-edge data analysis models and industry resource networks, we continue to empower novice investors to establish a cognitive framework, help professional institutions capture alpha returns, and jointly seize value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile and investment carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com