Written by: Monk

1. Bitcoin Market

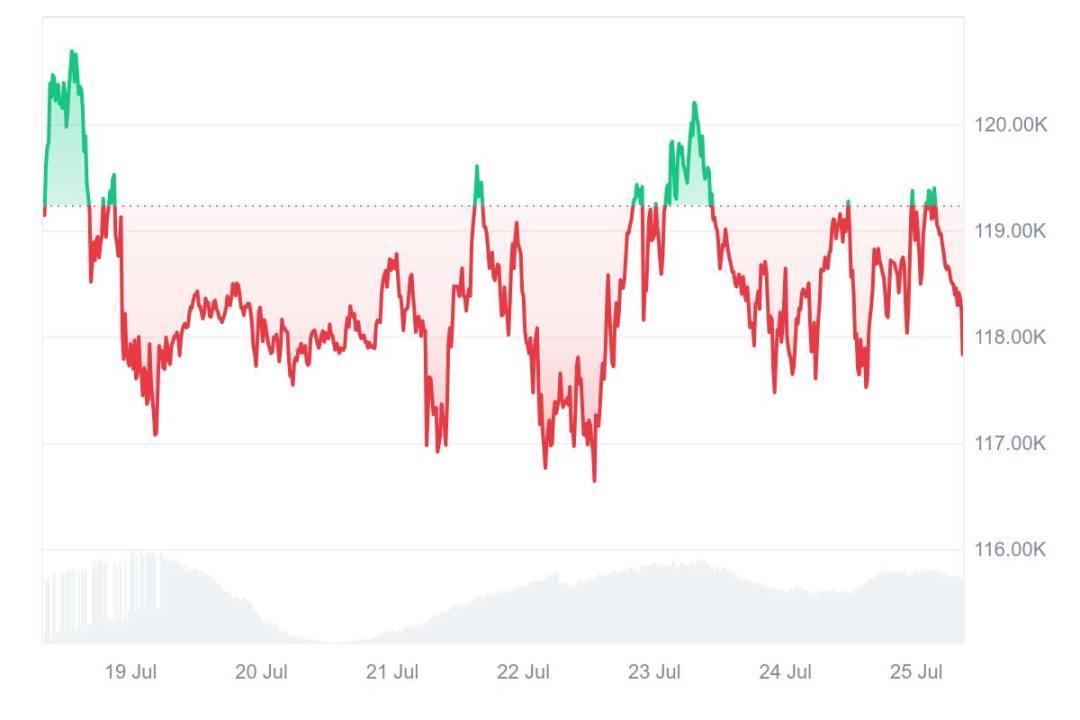

From July 19 to July 25, 2025, the specific trend of Bitcoin is as follows:

July 19 : Bitcoin price started to fluctuate downward in the morning, and it fell from $117,930 to $117,073 before rebounding. It rose to $117,912 and started to fluctuate upward. It weakened after rising to $118,426. It fell back to $117,721 in the evening and stabilized again. It closed at $118,113 at the end of the day. The power of buyers and sellers was relatively balanced.

July 20 : Bitcoin as a whole showed a narrow range of fluctuations and a strong trend. After opening, it slightly dropped to the intraday low of $117,544, and then entered a typical step-by-step upward structure. The price gradually climbed and broke through $118,117 and $118,287 successively. At the end of the day, it further rose to $118,731, showing that the bulls' intention to control the market has increased.

July 21 : Continuing the previous day's upward momentum, the price rose to $118,778 before a technical correction, and then quickly rebounded to around $118,557. However, the market suddenly fell in large volume, falling to a low of $116,914, and then a rapid V-shaped reversal occurred under the impetus of strong buying. The price not only rebounded to $118,644, but also broke through $119,605. Although it failed to stabilize at this high level and fell back to $118,016 in the short term, it rose again to $119,072 in the late trading and finally closed at $118,377. The intraday fluctuations were violent, and the long-short game was extremely fierce, indicating that the market sentiment was turbulent in the short term.

July 22 : The price continued the high volatility of the previous day. It started to decline from $117,473 in the morning, fell to $116,762 as low as before rebounding. It showed a fluctuating upward trend for a period of time, rebounded to $117,804 and then bottomed out again at $116,639, forming a Double Botto structure and gaining effective support. Bitcoin resumed its upward trend in the afternoon, fluctuated upward and successfully broke through the $119,000 mark, reaching a high of $119,429. Although it experienced a brief correction in the evening, the bulls quickly took over and maintained a strong trend, and finally closed at $118,956, indicating that the market bullish intention has increased.

July 23 : Continuing the strong trend of the previous trading day, Bitcoin continued to rise after opening, reaching a high of $120,204, a recent interim high. However, it failed to achieve an effective breakthrough in front of the key psychological barrier, and the price gradually fell back to $117,915. Subsequently, the bulls and bears fought fiercely, and the price fluctuated, reaching a low of $117,474, indicating that the bulls and bears fought fiercely in the high area.

July 24 : Bitcoin continued to fluctuate widely at high levels, with frequent intraday changes in long and short forces. In the morning, the price was consolidated in the range of US$117,500 to US$118,700, and then the bulls exerted their strength, the price rose and formed a short sideways trend near US$119,000, and the highest reached US$119,274. However, after reaching this interim high, it encountered rapid selling pressure and the price fell rapidly, reaching a minimum of US$117,523. After that, the market staged a strong rebound again, setting a new intraday high of US$119,373 in the late trading, and a slight correction before the closing. The overall pattern of violent fluctuations was maintained, indicating that the divergence between long and short positions in the current range is still significant.

July 25 : Bitcoin maintained the high volatility of the previous trading day, and continued to rebound in the morning, with prices rising to a high of $119,398. However, this position once again became a short-term resistance, and then the market turned into a downward channel, and the price quickly fell back to around $117,850, and all the short-term gains were lost. As of the time of writing, Bitcoin is temporarily reported at $117,859, and has not yet left the oscillation range. Overall, in the short term, the price is still in the oscillation consolidation area of $117,500 to $119,500. If there is no strong breakthrough, the oscillation pattern is expected to continue, and short-term trading still needs to be vigilant against the risk of sudden reversal.

Summarize

This week, the overall trend of Bitcoin showed a wide range of fluctuations. In the early stage, it showed a narrow sideways consolidation, and in the later stage, it showed a fierce game between bulls and bears at high levels, and market volatility significantly intensified.

Specifically, from July 19 to 20, the price fluctuated in a narrow range around $118,000, with a relatively limited fluctuation range, which is a typical accumulation and consolidation stage. Since July 21, market volatility has intensified, and Bitcoin prices have frequently experienced rapid pull-ups and deep pullbacks during the day, showing an obvious wide range of fluctuations. During this period, it repeatedly attacked the $119,000 and $120,000 integer levels, but failed to achieve an effective breakthrough, indicating that the upper selling pressure is heavy. At the same time, the lower support also performed strongly, falling to a minimum of $116,639 and then rebounding rapidly, indicating that the bulls actively took over below the key support level, and the market capital game was fierce.

The highest point of the week was $120,204, and the lowest point was $116,639, with an amplitude of 3.06%. The high-level oscillation pattern has not been broken from the technical perspective, and it is still treated as oscillating and strong in the short term. It is necessary to pay attention to the breakthrough of the pressure range of $119,000 to $120,000 and the effectiveness of the support range of $117,500 to $116,500. The subsequent trend may be guided by changes in trading volume and macro news.

Overall, although Bitcoin did not achieve a clear breakthrough this week, the bullish momentum has been revealed. If the market breaks through the key resistance level in the future, it may usher in a new round of trend market. On the contrary, if it falls below the key support area again, it is not ruled out that it will enter a deeper adjustment stage.

Bitcoin price trend (2025/07/19-2025/07/25)

2. Market dynamics and macro background

Fund Flows

1. Market funds are diverted to Altcoin, and Bitcoin's market share is declining

According to market data, Bitcoin’s market share (BTC Dominance) has been declining for 8 consecutive days, falling to 61.15% as of July 20, lower than the full-year high of 2024 (61.53%). The continued decline in Bitcoin’s market share indicates that the “copycat season” is gradually opening up.

On July 22, Coingecko data showed that Bitcoin's market share further dropped to 58.5%, mainly driven by the strong performance of mainstream Altcoin such as Ethereum (ETH) and Ripple (XRP): ETH's seven-day increase was 25.0%, XRP rose 20.4%, SOL and BNB rose 15.4% and 10.2% respectively.

Crypto analyst @DaanCrypto pointed out that in the past month, the growth of most of the top 100 Altcoin by market value has outperformed Bitcoin, which is the core driver of the decline in market share.

2. Miners and whale sold off heavily, and BTC inflows to exchanges hit a new high

As Bitcoin price climbed to all-time highs, on-chain data shows that a massive sell-off occurred simultaneously:

On July 15, Bitcoin’s daily exchange inflows surged to 81,000 BTC, the highest since February.

Among them, the inflow of whale with a single transfer of more than 100 BTC surged from 13,000 BTC to 58,000 BTC

During the same period, miners transferred out 16,000 BTC, almost all of which flowed into exchanges

Ethereum also showed a similar trend: 2 million ETH flowed into the exchange on July 16, the highest point since the end of February this year, indicating that the market's short-term profit-taking sentiment has increased significantly.

3. Various holding entities restart the hoarding mode, and funds turn to on-chain deposits

Despite the intensified short-term market volatility, on-chain data shows that various types of coin holders have returned to "hoarding" behavior. Glassnode's July 21 report pointed out that almost all wallet groups, from small investors to whale with tens of thousands of coins, have re-entered the "perfect hoarding mode." The on-chain activity of whale wallets has returned to the level of December 2024, indicating that the market as a whole has strong confidence in the medium- and long-term trend.

4. The on-chain distribution of long-term holders has increased, but it is difficult to change the trend of medium- and long-term net capital inflows

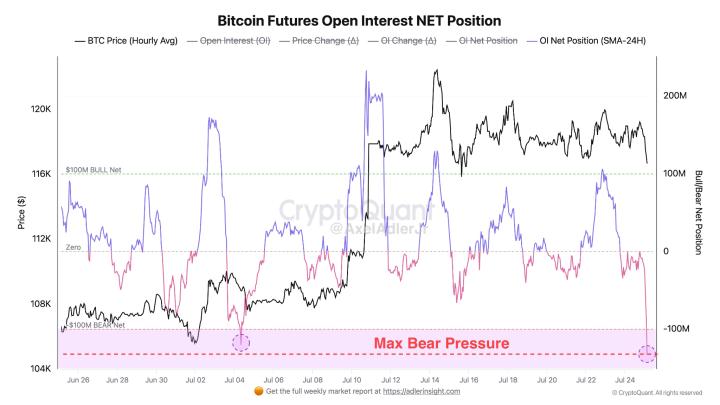

On July 24, CryptoQuant analyst Axel Adler Jr pointed out that Bitcoin currently has an abnormally high monthly capital destruction (CDD) / annual CDD ratio of 0.25, which is comparable to the 2014 peak and 2019 correction levels, reflecting that long-term holders (LTH) are transferring dormant BTC back to the chain in preparation for sale.

This phenomenon means that experienced investors in the market (especially old coin holders) are actively distributing their chips; the bullish trend is subject to a certain degree of "internal distribution resistance"; and the current price has triggered profit-taking behavior among some early coin holders.

However, Axel emphasized that despite the selling pressure on LTH's behavior, US ETFs continue to attract funds (see Part 5); Treasury funds are still allocating assets; therefore, this round of distribution is more likely to be just a signal of a slowdown in short-term gains, rather than the beginning of a complete reversal of the trend.

5. Current ETF funds continue to flow in

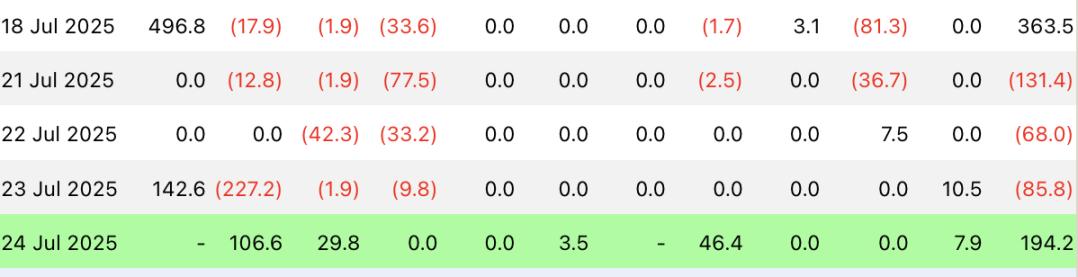

This week's daily ETF fund inflow/outflow details:

July 21: -$131.4 million

July 22: -$68 million

July 23: -$85.8 million

July 24: +$194.2 million

ETF Inflow/Outflow Data Image

Despite outflows on some dates, the overall performance of the U.S. spot Bitcoin ETF remains strong: on July 20, total on-chain holdings exceeded 1.285 million BTC, accounting for 6.46% of the total Bitcoin supply, corresponding to a market value of approximately US$151.8 billion.

At the same time, the Ethereum ETF performed particularly well last week, recording a net inflow of $2.182 billion, which not only set a record for the highest single-week in history, but also doubled from the previous week. The Bitcoin ETF also recorded a net inflow of $2.385 billion during the same period, ranking seventh in the ETF's single-week fund inflow record (fifth in the previous two weeks). This trend shows that both mainstream assets such as Bitcoin and alternative mainstream assets such as Ethereum have received continuous attention and active allocation from institutional and retail investors, further consolidating the position of ETFs as a medium- and long-term investment tool for digital assets.

In addition, there are positive signals from Grayscale. On July 24, Grayscale Investments announced that its Bitcoin Mini Trust ETF (Grayscale Bitcoin Mini Trust), listed on the New York Stock Exchange, has exceeded $5 billion in assets under management since its launch on July 31, 2024. As of July 23, it reached $5.415 billion, and the cumulative Bitcoin holdings reached 45,721, with a significant growth rate. Overall, ETFs are becoming an important channel for mainstream capital to enter the Bitcoin market, providing solid support for the overall market liquidity and price center.

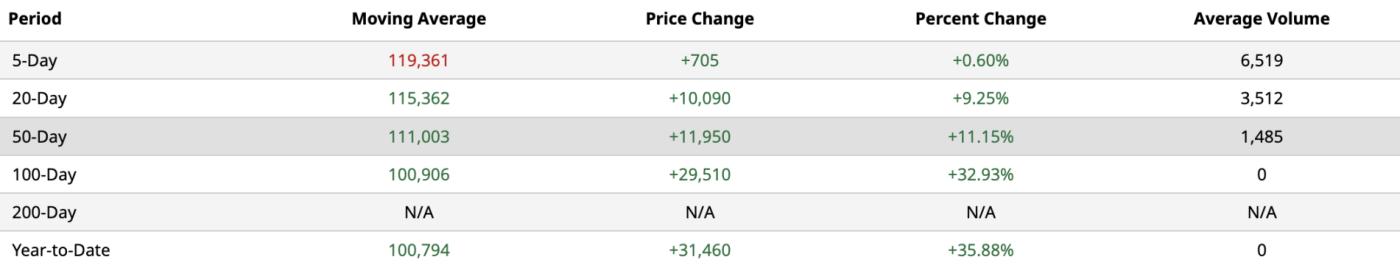

Technical indicator analysis

1. Relative Strength Index (RSI 14)

According to Investing.com data, as of July 25, 2025, Bitcoin's 14-day relative strength index (RSI) was 39.963, which is in the sell signal area. Typically, the RSI runs in the 30-70 range, with values below 30 considered oversold and values above 70 considered overbought.

The current RSI is around 40, indicating that the market is in a weak and volatile phase, with momentum on the short side but no extreme oversold conditions. This position reflects that market sentiment is still cautious and buying power has not yet returned significantly.

Although the RSI has not yet entered the oversold area, if the RSI continues to rise and breaks through the 50 line, it will mean that the short momentum has weakened and the bulls are expected to regain control of the market rhythm; on the contrary, if the RSI falls below 35, it will release a stronger signal of weakness and we need to be vigilant about the risk of further market decline.

2. Moving Average (MA) Analysis

5-day moving average (MA5): $119,361

20-day moving average (MA20): $115,362

50-day moving average (MA20): $111,003

100-day moving average (MA100): $100,906

Current market price: $117,480

MA5, MA20, MA50, MA100 data images

The current price is running between MA20 and MA5, indicating that the market is in a short-term shock correction period:

MA5 > current price > MA20: It indicates that the short-term momentum has shown signs of slowing down, and the short-term moving average has turned downward, reflecting that there is a certain profit-taking pressure in the market.

MA20 is significantly higher than MA50 and MA100: This indicates that the medium-term trend remains in an upward structure and the long-term moving average system provides solid support.

If the price regains its footing above MA5 and the volume increases, the short-term trend is expected to strengthen; on the contrary, if it loses MA20, it may test the support strength of MA50 below.

The moving averages are in a typical bullish arrangement, and the medium- and long-term trends remain healthy. As long as the price does not significantly fall below MA50, the overall structure will remain bullish.

3. Moving Average Convergence Divergence (MACD) Analysis

According to Investing.com data, as of July 25, the MACD fast line was -76.53. Currently, both the MACD fast and slow lines are below the 0 axis, and the fast line continues to cross the slow line, forming a death cross pattern, releasing a clearer "sell signal". The expansion of the bar chart shows that the downward momentum is increasing and the bears are dominating the market.

The continued expansion of the MACD death cross position indicates that the short-term downward trend may continue. If the subsequent Histogram begins to converge and the death cross shrinks, it may be a precursor to the brewing period of a rebound, and we need to pay close attention to the timing of the 0 axis crossing.

4. Key support and resistance levels

Support level : The current short-term key support levels for Bitcoin are $117,500, $117,000 and $116,500. From the recent price behavior: On July 19, 21 and 22, BTC fell back to around $117,000 several times, and all received effective support, indicating that the market has strong buying power in this area. During the severe decline from July 21 to 22, the price once touched around $116,500, but rebounded quickly, indicating that this position is the short-term bottom support area of the current market, with a strong stop-loss effect. On July 24, the intraday bottomed out to around $117,500 several times and then rebounded, verifying that the willingness to buy at this price is strong, and it constitutes an effective defense line in the short term. If the market falls below $116,500 in the future, it is necessary to pay attention to the bearing capacity of the lower support level below, including the 115,000 integer mark.

Resistance : The main resistance levels that Bitcoin faces in the short term are $119,000 and $120,000, of which $119,000 is a key technical level that has been repeatedly blocked in recent trading. On July 21, 22, and 24, the price tested the $119,000 resistance several times, but failed to break through effectively. Each time it approached or briefly broke through, it fell back, indicating that the selling pressure in this area was heavy. On July 23, it briefly broke through $120,000, but did not form an effective stabilization, and then fell back quickly, confirming that this level is still an important threshold for bulls to attack. In the medium term, if it can effectively break through $120,000 and stabilize, further upward pressure will be concentrated at $121,000.

Comprehensive analysis

In terms of the current structure, Bitcoin will remain in the range of $116,500 - $120,300 this week, and the market is waiting for a new direction. In the short term, the support gradually moves upward, indicating that the bulls have a certain willingness to take over, but the selling pressure from above is still obvious, and there is no obvious large-volume breakthrough. The overall market is neutral and bullish. If the market breaks through $120,000 and stabilizes, it is expected to challenge $121,000, or even start a new round of upward trend; on the contrary, if it falls below $116,500, it is necessary to guard against the risk of weakening short-term sentiment and a callback to the $115,000-$114,000 range to seek new support.

Market sentiment analysis

1. Emotional profile

This week, the overall sentiment of the Bitcoin market showed a positive and optimistic trend. Although the price continued to fluctuate in the high range and the fluctuation range was significant, investors generally showed strong confidence in holding positions and risk appetite. There were many "roller coaster" fluctuations during the day, reflecting the fierce game between the long and short sides around the key price.

From July 19 to 20, the price of Bitcoin remained sideways in a narrow range. The market sentiment was relatively cautious, wait-and-see sentiment intensified, and funds did not flow in or out significantly, reflecting that investors tended to wait for direction choices near key points.

On July 21 and 23, the market trend showed a typical "false breakthrough + rapid retracement" market. Bitcoin broke through the short-term resistance twice and then quickly fell back, indicating that the bulls lacked momentum and the bears fought back quickly, causing short-term fluctuations in market sentiment. In particular, the frequent inflow and outflow of highly leveraged funds further amplified short-term fluctuations and caused short-term sentiment to swing violently.

Overall, the price of Bitcoin has remained in a relatively high and wide range this week ($116,500 - $120,300). Although the market sentiment is optimistic, it shows strong uncertainty under the repeated interweaving of long and short forces. The bulls are still confident, but there is a lack of clear breakthrough catalysts, while the bears repeatedly put pressure on key resistance levels, forming a typical high-level game pattern.

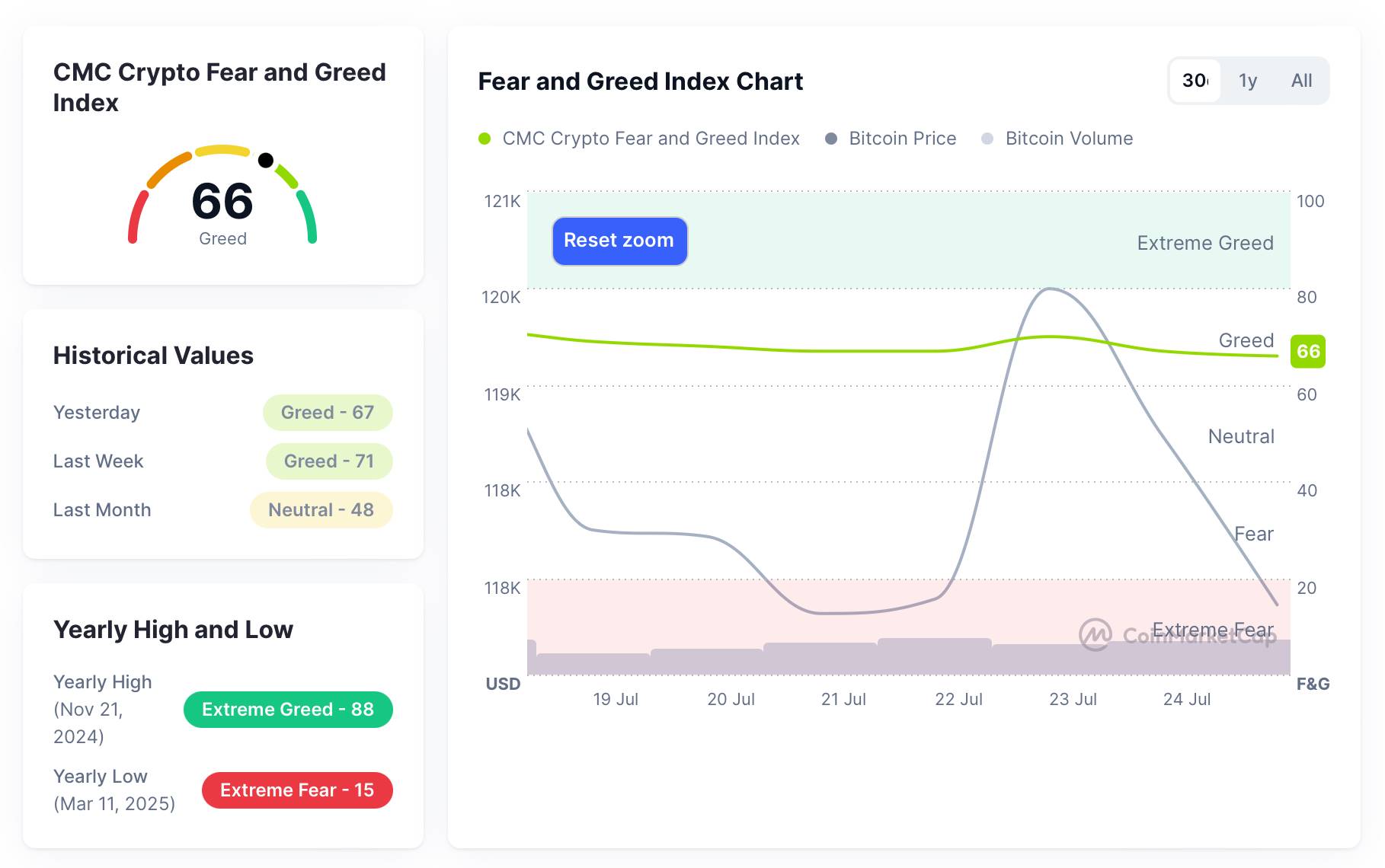

2. Key Sentiment Indicators (Fear and Greed Index)

As of July 25, the Fear & Greed Index was temporarily reported at 66, which is in the "Greed" range, indicating that the current market participants are generally optimistic and willing to continue to participate in long transactions at high levels. Despite the large price fluctuations, the overall market risk appetite remains high, and retail investors and some institutional investors are still actively participating in the layout.

Looking back at this week (July 19-July 24), the daily values of the Fear and Greed Index were: 69 (greed), 68 (greed), 67 (greed), 67 (greed), 70 (greed), 67 (greed). The index continued to remain in the 67-70 range this week, with small fluctuations, and was always on the high edge of the "greed" area, indicating that despite the short-term technical correction in the market, the sentiment has not been substantially suppressed. This kind of sentiment structure often means that the market may have entered a high sentiment platform period, and once there is a lack of new upward drivers, it may trigger an emotional correction.

It is particularly noteworthy that when the Fear and Greed Index continues to run at a high level and the price fails to effectively break through the key resistance range above, the market may be accumulating potential risks of sentiment divergence, and the market needs to be vigilant about the periodic adjustment pressure brought about by "emotional overheating" in the future.

Overall, from the linkage between sentiment indicators and price behavior, the overall Bitcoin market is in a strong and volatile pattern at a high level this week. Although investor sentiment is optimistic, it has shown a certain degree of high-level hesitation and fund rotation. The continued greedy sentiment and the sharp fluctuations in the short cycle indicate that the market is in a highly sensitive critical stage. In the next week, if the price cannot effectively break through the previous high and stand firm at the key psychological level, market sentiment may face a transition process from optimism to caution. Investors are advised to pay close attention to changes in trading volume, on-chain capital flow data, and the evolution of macro-catalytic factors to prevent the risk of price retracement caused by short-term sentiment fluctuations.

Fear and Greed Index Data Picture

Macroeconomic Background

1. Trump’s “Fed Pressure Action”

On July 24, Trump made a surprise visit to the Fed headquarters, using the excuse of criticizing the more than $700 million in renovation overspending to further pressure Fed Chairman Powell, demanding a substantial interest rate cut and hinting at possible early personnel changes.

This move was interpreted by the market as interference with the independence of the central bank. Although it did not trigger severe dollar volatility in the short term, it clearly increased policy uncertainty and boosted demand for safe-haven assets (such as Bitcoin).

2. Powell's speech and key economic data combination

On July 22, Powell reiterated at the European Conference that "the Fed will stick to data-driven and will not be swayed by political motives," implying that the interest rate cut will not be affected by the current situation.

On July 23-24, second-hand housing sales, new housing starts, manufacturing and service PMI, and quarterly reports of about 112 companies will be released intensively. If the core inflation data is unexpectedly weak, it may once again stimulate market expectations of interest rate cuts and guide funds into Bitcoin.

3. China's economic recovery boosts global risk appetite

On July 21, China's second-quarter GDP grew by 5.2% year-on-year, exceeding market expectations, which led to a rebound in risk appetite in global markets and capital inflows into risky assets.

At the same time, international trade tensions eased, U.S. stocks fluctuated and consolidated, and funds gradually poured into crypto assets.

4. Fund rotation trend: Bitcoin's safe-haven role is highlighted

On July 22, the latest analysis showed that the correlation between BTC and traditional stock markets (S&P, Nasdaq) has dropped to about 0.2, and funds flow into the crypto market when stocks pull back.

Bitcoin has risen 3.5% since the beginning of July, with its total market value remaining between $3.4-4 trillion, and the weakening of U.S. stocks providing short-term upward momentum.

5. Traditional finance further embraces the crypto ecosystem

On July 22, JPMorgan Chase is considering incorporating crypto assets (BTC/ETH) into the credit collateral system, marking a larger-scale institutional entry.

This shift is seen as a signal of institutional entry, helping to reduce crypto market volatility and increase market depth.

6. Huge ETF fund inflows

According to statistics on July 23, as of mid-July, the net inflow of US spot Bitcoin ETFs has exceeded $54.8 B, and from early to mid-July there were two consecutive days of inflows of more than $1 B per day.

Such capital flows provide solid price support for Bitcoin, explaining the recent upward momentum.

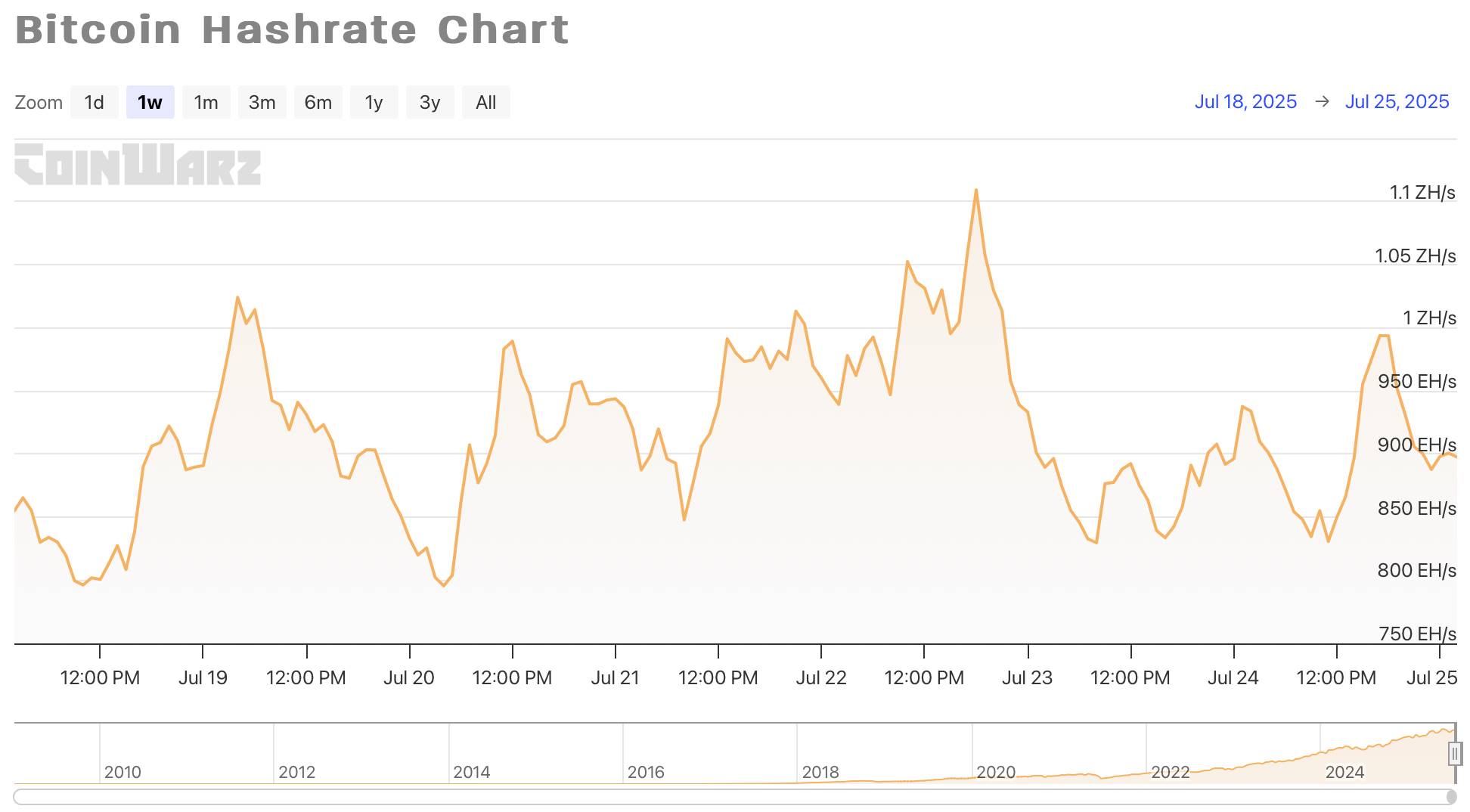

3. Hash rate changes

From July 19 to July 25, 2025, the Bitcoin network hash rate fluctuated as follows:

On July 19, the hash rate of the entire network showed a trend of "rising first and then falling", rising from 890.76 EH/s to 1.0240 ZH/s (i.e. 1,024.0 EH/s) during the day, and then gradually falling back to 833.26 EH/s at the end of the day, indicating that miners may perform short-term power outages or maintenance operations after high load. On July 20, the hash rate steadily climbed from the daily low of 795.58 EH/s to 989.33 EH/s. Although there was a slight correction to 909.64 EH/s during the period, it remained at 943.78 EH/s at the end of the day, showing an overall warming trend. On July 21, the hash rate fluctuations intensified, first falling sharply to 847.81 EH/s, then rebounding rapidly, and reaching 975 EH/s at noon, and rising to 1.0131 ZH/s in the evening, the high point of the day, indicating that miners quickly resumed output after the short-term recovery of electricity or environment.

On July 22, the hash rate retreated slightly to 939.25 EH/s, and then gradually climbed to 992.62 EH/s, 1.0524 ZH/s, and up to 1.1092 ZH/s, reaching a peak this week. However, it failed to maintain and then retreated sharply, falling to 933.24 EH/s at the end of the day, indicating that large-scale fluctuations may be related to the intermittent online and offline of some mining farms. On July 23, the hash rate continued the retreat trend of the previous day, falling sharply to 829.70 EH/s during the day, falling back to the low area at the beginning of this week, reflecting that the miners may still face operating costs or external power supply pressure. It briefly rebounded to 892.35 EH/s in the midday stage, and then fell again, but the downward range slowed down. In the evening, the hash rate gradually stabilized and slowly rose to 937.62 EH/s, indicating that the network computing power began to recover. On July 24, the hash rate retreated again in the morning, reaching 830.78 EH/s, and then started a clear upward trend, rising to an intraday high of 993.70 EH/s in the afternoon. However, this level was not effectively maintained, and it subsequently fell back to 887.72 EH/s. The overall trend shows that the computing power has recovered.

From July 19 to July 25, 2025, the overall hash rate of the Bitcoin network showed a state of "first oscillating upward, then falling back from a high position". In the first half of the week (July 19 to July 22), the hash rate was in an upward state as a whole, and the low point of the decline continued to move upward, reflecting the gradual strengthening of network stability and the resumption of some large mining farms. The highest point during the period appeared on July 22, reaching 1.1092 ZH/s. However, this high did not last, and there was a significant retracement immediately, which may be related to the strategic shutdown of some mining farms, fluctuations in electricity prices or changes in the external environment. In the second half of the week (July 23 to July 24), the hash rate quickly dropped to the low range at the beginning of the week, as low as 829.70 EH/s, but then gradually stabilized and rebounded, reaching 993.70 EH/s on July 24. Although it eventually fell back, it showed an overall oscillating repair trend, indicating that the network computing power has a certain recovery ability, and the miners' response to market conditions is also relatively flexible.

Overall, the trend of Bitcoin hash rate this week reflects the sensitivity and flexibility of current miners' operations. On the one hand, under the influence of external factors such as electricity costs and climate, the operation of computing power shows strong short-term volatility; on the other hand, with the price still attractive, the rapid recovery of computing power also shows that miners are still willing to maintain output. If external conditions tend to stabilize in the future, it is expected that the hash rate will gradually return to a high range.

Bitcoin network hash rate data

4. Mining income

According to YCharts data, the total daily income of Bitcoin miners this week (including block rewards and transaction fees) is as follows: July 19: $55.14 million; July 20: $55.35 million; July 21: $55.85 million; July 22: $56.70 million; July 23: $52.38 million. Overall, the average daily income of miners this week fluctuated between $52 million and $57 million, showing a more stable trend compared with last week. Although there was a slight decline on July 23, the overall fluctuation was small, reflecting that the current market is at a relatively stable level of block generation and transaction activity.

From the perspective of daily revenue per unit of computing power (Hashprice), Hashrate Index data shows that Hashprice is relatively stable this week. As of the time of writing on July 25, Hashprice is temporarily reported at $59.65/PH/s/day. This week, Hashprice is relatively stable overall and shows a mild upward trend. From the trend, the low point of Hashprice is gradually moving up, indicating that the unit output efficiency of miners has improved and the mining return has improved slightly.

July 23 was the high point of the week, when the Hashprice reached $60.33/PH/s/day, showing the market's short-term repair momentum for mining revenue. The Hashprice on July 25 was $60.10/PH/s/day, which was the second highest level of the week. Overall, the Hashprice fluctuated less during the week, reflecting that the market has entered a relatively stable stage and the miners' income structure has not changed dramatically. From a monthly perspective, the current Hashprice is at the median level of the past 30 days. The price fluctuations over the past two weeks have tended to converge. The market is getting rid of the early drastic adjustments and gradually returning to normal. From a quarterly perspective, the Hashprice is at a medium-to-high level in the past three months, which is still an acceptable range for most miners with good operating efficiency, helping to maintain the enthusiasm for computing power investment.

The steady increase in Hashprice during this period is related to the slowdown in the growth of the hash rate of the entire network. As the network competition pressure has not increased significantly and the Bitcoin price remains in a relatively high range, the unit computing power income obtained by miners has shown a phased recovery, which is conducive to improving the activity of mining activities in the medium and short term.

Hashprice data

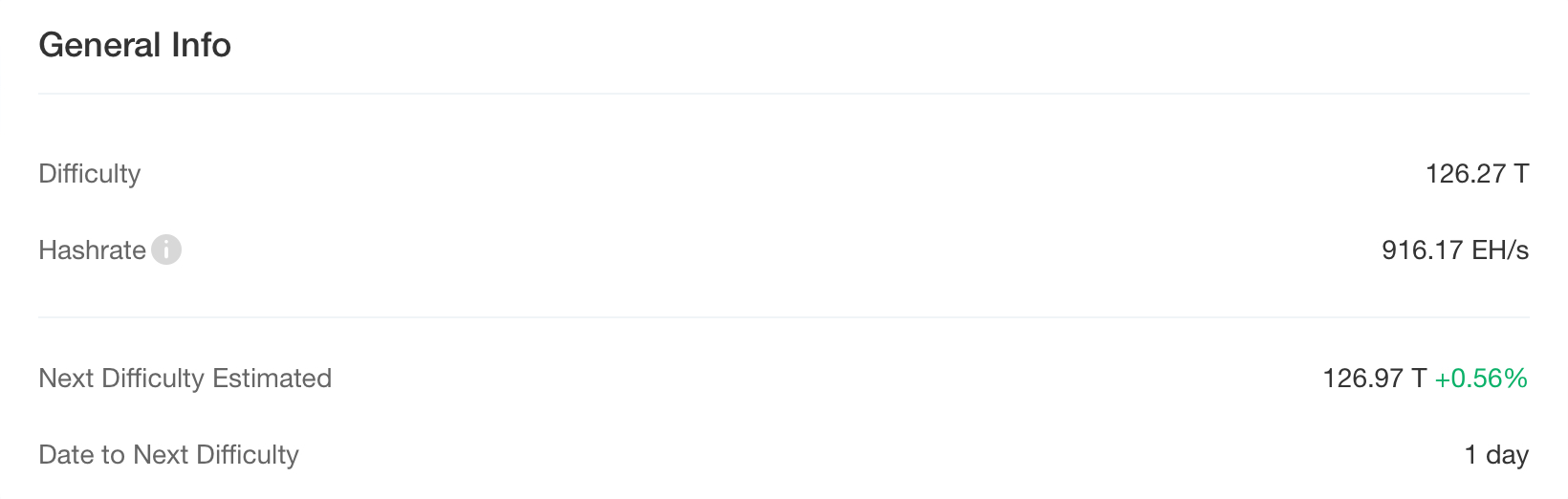

5. Energy costs and mining efficiency

According to CloverPool data, as of July 25, 2025, the total Bitcoin network computing power has risen to 916.17 EH/s, and the mining difficulty is 126.27 T. The next round of difficulty adjustment is expected to be carried out on July 26, with an increase of about 0.56%, and the difficulty is expected to rise to 126.97 T. This phenomenon reflects that miners remain optimistic about the prospects of the network and the intensity of competition continues to increase.

Bitcoin mining difficulty data

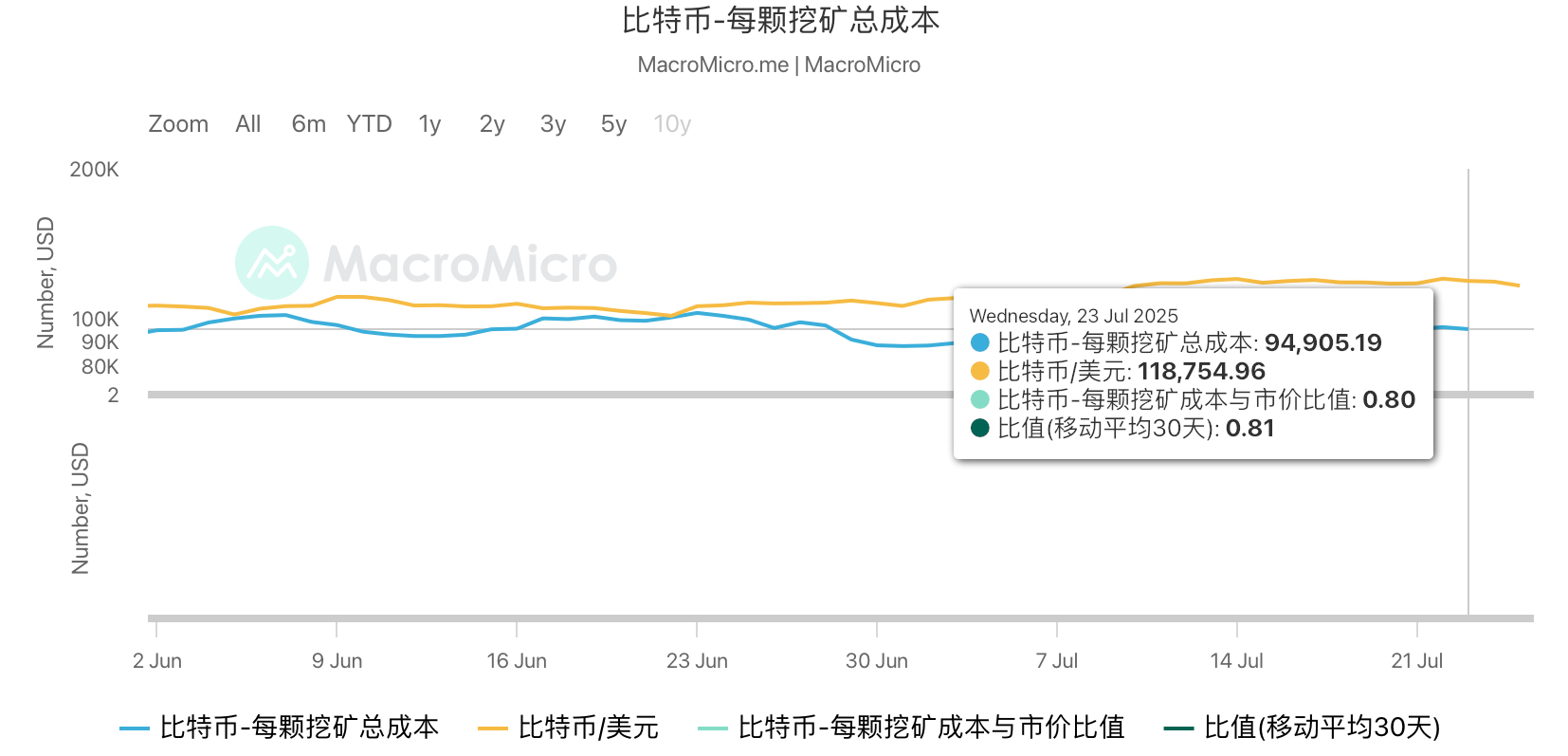

From the perspective of mining costs, according to the latest model data from MacroMicro, the average production cost as of July 20 was approximately $95,333, and the cost/current price ratio corresponding to the spot price of $117,300 on that day was approximately 0.81; the latest data on July 23 also showed that the cost was approximately $94,905, the current price was approximately $118,755, and the cost ratio was 0.80, which fluctuated in the range of 0.80–0.81 overall. This cost ratio level means that miners can obtain an average gross profit margin of approximately 20%, and the current Puell Multiple is at a level of 1.38–1.39, and the block reward value is still higher than the annual average, indicating that miners' income is relatively considerable. In addition, the daily issuance from July 19 to 24, 2025 was stable at 437–469 pieces, and the total market value was in the range of 2.33–2.39 trillion US dollars. The supply rhythm was stable, matching the demand, and maintaining a stable relationship between price and cost.

The total cost of mining each Bitcoin

This week, Bitcoin mining maintained a good profit status. Although the unit production cost has increased, the spot price is high, and the mining cost-spot price ratio remains around 0.80. Miners still have an average profit margin of about 20%, and the overall cash flow is sufficient. The computing power of the entire network has steadily increased, and the difficulty is expected to increase, reflecting the strong confidence of miners and the continued intensification of industry competition. However, as the difficulty of mining reaches a new high, high-energy consumption and low-efficiency mines are facing the pressure of elimination. Future profitability will depend on the trend of Bitcoin prices and whether miners can optimize energy efficiency or migrate to areas with low electricity prices. Overall, the mining industry is operating steadily in the short term, but it is still necessary to pay attention to the potential risks brought about by changes in energy costs and market fluctuations.

6. Policy and regulatory news

IMF confirms that El Salvador’s Bitcoin holdings remain unchanged, and the purchase of coins is in line with the agreement commitment

On July 20, the Minister of Finance and the Governor of the Central Bank of El Salvador confirmed to the International Monetary Fund (IMF) that the government has not purchased any more Bitcoin since the signing of the financing agreement in February 2025, the current number of Bitcoins remains unchanged, and the relevant wallet addresses have been provided to the IMF for monitoring. On July 24, the IMF further stated that the Bitcoin accumulation behavior of the El Salvador Strategic Bitcoin Reserve Fund meets the conditions of the plan, and the total amount of Bitcoin in the current government wallet has not changed, which is in line with the commitments of the agreement. The above statement is inconsistent with President Bukele's statement that "1 Bitcoin is purchased every day." The IMF pointed out that the growth of Bitcoin balances only reflects internal integration and does not violate the terms of the agreement.

Related images

7. Mining News

Brazilian miners warn of $1 billion in retaliatory tariffs on U.S.

On July 22, the Brazilian mining industry warned that if the government takes reciprocal tariff measures in retaliation for US President Trump's threat to impose a 50% tariff starting August 1, it will have severe economic consequences.

Raul Jungmann, head of the Brazilian Mining Association (Ibram), said the mining sector would face up to $1 billion in additional costs a year if Trump follows through on his threats and Brazil takes such countermeasures. Brazilian mining executives are considering opening a dialogue with U.S. companies to push the Trump administration back to the negotiating table.

Bitcoin mining company Mawson has fired its CEO for alleged fraud and misconduct

On July 22, The Miner Mag reported that Bitcoin mining and hosting company Mawson Infrastructure has fired CEO and president Rahul Mewawalla and revoked his board seat for breach of fiduciary duty and fraud. Mawson has filed a lawsuit in the Delaware Chancery Court seeking compensation.

Mewawalla, who previously received a $2.5 million bonus and 1.2 million restricted shares for “high performance,” raised his annual salary to $1.2 million. In his response, he denied wrongdoing and stressed that under his leadership, the company’s revenue grew 36% and gross profit grew 35%.

In addition, Mawson has recently been involved in a lawsuit against NYDIG and its parent company Stone Ridge involving a custody dispute involving more than 20,000 mining machines worth $30 million.

Related images

Russian official: State should confiscate crypto from illegal miners

On July 23, Yevgeny Masharov, a member of the Russian Public Chamber of Commerce and a policymaker, said that authorities should be given the power to confiscate cryptocurrencies from illegal or quasi-legal Bitcoin miners. Masharov believes that this proposal will deter "gray" miners by "making illegal mining unprofitable."

Masharov said that illegal miners in many regions put huge pressure on their power grids and that if the proposal is accepted, Russian regions, "especially those with energy shortages, will breathe a sigh of relief."

8. Bitcoin related news

Global corporate Bitcoin holdings dynamics (statistics for this week)

1. El Salvador (Country):

According to mempool data on July 20, El Salvador's national bitcoin holdings have exceeded 6,200, with the current holdings at 6,242.18 BTC, with a total value of approximately US$736 million. This indicates that the country continues to implement the "Bitcoin national policy" and steadily accumulate digital asset reserves.

2. Vaultz Capital, UK

On July 21, British listed company Vaultz Capital announced that it had increased its holdings of 20 bitcoins. After the purchase this week, its total bitcoin holdings have risen to 70. The company has recently begun to accelerate the layout of bitcoin assets as part of its digital asset allocation.

3. The Blockchain Group in Europe

According to an official announcement on July 21, European listed company The Blockchain Group increased its holdings of 22 BTC this week, with a total investment of approximately 2.2 million euros. The latest statistics show that its total Bitcoin holdings have reached 1,955, and its holding yield from the beginning of the year to date is as high as 1,373.2%, showing a strong return on investment.

4. Sequans Communications, USA

On July 21, Sequans, a US-listed company, significantly increased its holdings of 1,264 bitcoins this week, purchasing about $150 million worth of bitcoins. This increased its total bitcoin holdings from 1,053 to 2,317, making it one of the US-listed companies with the largest increase in holdings this week.

5. Genius Group, USA

On July 21, Genius Group, a US-listed company, announced that it had increased its holdings by another 20 bitcoins, bringing its total holdings to 200. The company has continued to increase its holdings of BTC in recent years to enhance its asset diversification capabilities.

6. Australian Monochrome (IBTC Spot ETF)

Data disclosed on July 22 showed that Australia's Monochrome's IBTC spot Bitcoin ETF's BTC holdings had risen to 954 as of July 21. Based on the market price at the time, the total value of the holdings was approximately A$175 million, indicating that institutional investors continued to flow into the spot Bitcoin market.

7. Belgravia Hartford, Canada

According to an official announcement on July 24, Canadian company Belgravia Hartford purchased 25 new bitcoins, bringing its total holdings to 40.8.

Bitcoin Treasury Dynamics of Publicly Listed Companies (This Week)

1. Aether Holdings, a US listed company, will raise $40 million to buy Bitcoin

On July 19, Aether Holdings announced that it would raise $40 million and use most of the funds to purchase Bitcoin as part of its financial reserve strategy. As of press time, the company's market value is $158 million.

2. Swedish listed company H100 Group AB completes private placement to invest in Bitcoin

On July 21, H100 Group AB completed a private placement, raising approximately US$1.3 million to advance its Bitcoin treasury strategy.

3. Indian listed company Jetking expands Bitcoin reserves

On July 21, Jetking’s board of directors approved a private placement plan to raise 1.15 billion rupees, which will be mainly used for increasing Bitcoin holdings, general operations, and Bitcoin education and training.

4. US listed company Profusa signs $100 million financing agreement and launches Bitcoin reserve strategy

On July 21, Profusa (NASDAQ: PFSA) signed an equity credit agreement with Ascent Partners, intending to raise up to US$100 million to purchase Bitcoin as a core asset.

5. Trump Media Technology Group’s Bitcoin reserves have reached $2 billion

On July 21, Trump Media & Technology Group (DJT.O) announced that its total Bitcoin reserves have reached US$2 billion and will continue to acquire Bitcoin and related assets.

6. K Wave Media and Galaxy Digital Collaborate to Advance Bitcoin Strategy

On July 22, K Wave Media (NASDAQ: KWM) reached a strategic cooperation with Galaxy Digital, and has purchased 88 bitcoins and obtained nearly US$1 billion in institutional funding support.

7. Electric car company Volcon purchased 280 bitcoins for the first time and completed a $500 million private placement

On July 22, it was reported that Volcon, a US listed company, purchased 280.14 bitcoins for the first time and completed more than US$500 million in private equity financing for its bitcoin strategic deployment.

8. Mexican real estate group Grupo Murano plans to build a $10 billion Bitcoin vault

On July 22, Grupo Murano announced that it would invest $1 billion in Bitcoin and planned to build a Bitcoin asset reserve worth $10 billion within five years.

9. Swedish company Fragbite Group buys Bitcoin for the first time

On July 22, Fragbite Group announced its first purchase of approximately 4.3 bitcoins, launching the company’s bitcoin treasury strategy.

10. Japanese textile company Kitabo plans to purchase $5.4 million in Bitcoin

On July 22, Japan's Kitabo announced that it would purchase approximately 800 million yen (approximately US$5.4 million) of Bitcoin as part of its new financial strategy.

11. Metaplanet, a Japanese listed company, increased its holdings 66 times in one year, firmly sticking to its Bitcoin treasury strategy

On July 23, Simon Gerovich, CEO of Metaplanet, a Japanese listed company, said on social media that the company held only 246 bitcoins a year ago, and now its bitcoin holdings have increased to 16,352, a 66-fold increase. Metaplanet will firmly promote its Bitcoin treasury strategy established 15 months ago and will continue to move towards the "1% club."

12. Canadian listed company Matador received $100 million in financing to build Bitcoin reserves

On July 23, Canadian listed company Matador announced that it had received $100 million in financing, which will be used to advance its Bitcoin treasury construction plan.

13. Canadian listed company Planet Ventures plans to raise 5 million Canadian dollars to increase its holdings of Bitcoin

On July 23, Canadian listed company Planet Ventures announced that it plans to raise up to 5 million Canadian dollars (approximately 3.7 million US dollars) through convertible debt financing to further increase its holdings of Bitcoin and strengthen its position as a treasury.

14. Swedish listed company Hilbert Group reaches $15.8 million financing agreement to increase Bitcoin holdings

On July 23, Swedish company Hilbert Group signed a structured financing agreement with LDA Capital, totaling 150 million Swedish kronor (about 15.8 million U.S. dollars). The financing will be flexibly withdrawn within 36 months and used to gradually increase Bitcoin holdings. Hilbert will continue to advance its Bitcoin treasury strategy.

15. Canadian listed company Sixty Six Capital increased its holdings of 16.02 Bitcoins through ETF

On July 24, Canadian listed company Sixty Six Capital announced that it indirectly increased its holdings of 16.02 BTC by increasing its holdings of 114,000 units of Bitcoin ETF BTCC.B, bringing its total holdings to 148.8. The company clearly positioned itself as a "Bitcoin Treasury + Crypto Investment Company." In the future, it will convert ETF-equivalent BTC into spot Bitcoin holdings when feasible.

16. Nativo Resources announces adoption of Bitcoin as a financial reserve strategy

On July 24, Nativo Resources (LON: NTVO), a London-listed company, announced that it would adopt a digital asset fiscal policy, using part of its cash flow and financing funds to hold Bitcoin. The company believes that BTC and gold can be used together as reserve assets to combat inflation, and has partnered with Copper.co to provide custody services. The board of directors stated that despite price fluctuations and regulatory risks, the company still regards Bitcoin as one of its core fiscal tools.

17. Satsuma raises $135 million, setting a record for UK Bitcoin Treasury financing

On July 24, Satsuma Technology successfully raised 100 million pounds (about 135 million U.S. dollars) to establish a corporate Bitcoin treasury. If the company converts all funds into BTC, it will become the second largest Bitcoin holder in the UK. The current record is held by The Smarter Web Company, which holds 1,600 BTC.

18. Strategy increases financing scale to US$2 billion to increase Bitcoin holdings

On July 24, according to market news, Strategy (formerly MicroStrategy) increased its financing scale from US$500 million to US$2 billion to purchase Bitcoin. Previously, on July 22, Strategy announced the launch of its IPO, issuing 5 million shares of STRC stock, and the funds raised will be used for the purchase of Bitcoin and other company purposes.

Tim Draper: Macro factors will weaken the impact of Bitcoin halving cycle

On July 20, macroeconomic factors, including the depreciation of the U.S. dollar (USD), will weaken the impact of the Bitcoin halving cycle. The cyclical fluctuations of the Bitcoin market boom and bust since 2009 are precisely due to this halving cycle. Tim Draper, founder and partner of venture capital (VC) firm Draper Associates, pointed out in an interview.

“The dollar will disappear in the next 10 to 20 years,” Draper said in an interview. “The world is changing, and we are witnessing it. We are in the midst of a major leap forward in human civilization,” he added.

Tim Draper pointed out that investors increasingly view Bitcoin as a "safety valve" to deal with poor governance, distrust of banking institutions, fiat currency inflation, and geopolitical tensions, which are driving global adoption of Bitcoin, a digital currency with a limited supply. The venture capital firm added:

“If Bitcoin continues to trade against the dollar the way it is currently, the impact of the halving event may be lessened because the trend may continue for a longer period of time. It will still be somewhat affected by the four-year cycle, but I think the impact will be lessened.”

Michael Saylor: Only 10 Years Left to Get Bitcoin

On July 21, according to Cointelegraph, Strategy founder Michael Saylor said, “You have 10 years to get Bitcoin, and then there will be no Bitcoin left for you.”

Related images

Fundstrat Co-founder: Bitcoin price is expected to exceed $1 million in the next few years

On July 21, according to CNBC, Fundstrat co-founder and managing partner Tom Lee said in an interview with the "Squawk Box" program that the price of Bitcoin may exceed $1 million per coin in the next few years.

PlanB: Bitcoin is at least 10 times undervalued

On July 21, analyst PlanB posted on the X platform that "the market value of gold is about 20 trillion US dollars and the market value of Bitcoin is about 2 trillion US dollars. Therefore, the value of gold is 10 times that of Bitcoin. The scarcity of gold (stock-to-flow ratio) is about 60, and the scarcity of Bitcoin is about 120. Therefore, the scarcity of Bitcoin is twice that of gold. I think Bitcoin is at least 10 times undervalued."

Arthur Hayes: Bitcoin is expected to reach $250,000 by the end of the year, and Ethereum will reach $10,000

On July 23, according to Cointelegraph, Arthur Hayes predicted that the price of Bitcoin will reach $250,000 by the end of the year and Ethereum will reach $10,000.

Hayes noted that the Trump administration’s wartime economic policies are creating credit growth flowing into the cryptocurrency market, and the model of stablecoin issuers purchasing Treasury bonds to finance government deficits will further drive market gains.

Related images

Data: Only 5.3% of Bitcoin has not been mined, and more than 7.5% has disappeared forever

According to Curated Crypto data on July 24, only 5.3% of Bitcoin has not yet been mined. It is estimated that more than 7.5% of the total Bitcoin has permanently disappeared from circulation due to lost wallets, forgotten private keys or destruction.