Bitcoin traders are becoming cautious as the price approaches an important support level, though panic has not yet spread across the derivative market.

From Thursday to Friday, Bitcoin (BTC) dropped 4%, marking its first fall below $115,000 in two weeks. This correction coincided with the monthly derivative contract expiration, causing $390 million in futures contracts to be liquidated – approximately 14% of the total open interest.

To assess whether this volatility changes the market's long-term expectations, a closer examination of indicators from the Bitcoin futures and options market is necessary – tools that typically reflect professional investor sentiment clearly.

Under stable market conditions, monthly Bitcoin futures contracts typically trade with an annual premium of 5% to 10% compared to spot prices, to compensate for the extended settlement period. Currently, this premium is around 7%, in a neutral zone and close to the 8% recorded on Monday. This indicates that despite Bitcoin's $4,700 drop, the overall sentiment in the derivatives market remains relatively unchanged – reflecting stable medium and long-term expectations.

Bitcoin reached a record high of $123,181 on July 14, but futures market data shows the strongest recent surge actually occurred in early February. This period coincided with the US import tariffs and market disappointment with the Federal Reserve's decision to maintain interest rates, despite the January CPI remaining stable at 3% year-on-year.

To determine whether the current neutral position in the futures market accurately reflects investor sentiment, the Bitcoin options market skew needs further examination. When traders are concerned about potential corrections, put options typically have higher fees compared to call options, causing the 25-delta skew to exceed 6% – a signal indicating increasing defensive sentiment in the market.

On Friday, Bitcoin's 25-delta skew surged to 10% – a rare tension threshold that had only appeared nearly four months ago. However, this anxious sentiment quickly subsided, with the skew index rapidly returning to a neutral zone around 1%. This development suggests that major speculators and market makers are currently pricing risks balanced, with equivalent expectations for both upward and downward movements.

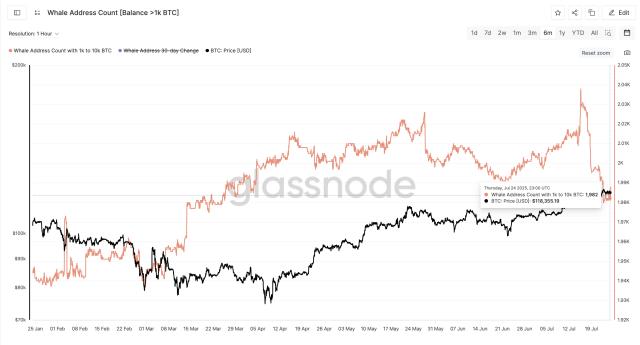

Bitcoin Traders Cautiously Observe 80K BTC Wallet Transactions

Bitcoin derivative market data shows traders are not rushing to buy when prices approach $116,000, but also show no signs of panic after the 7% correction from the historical high. This provides some reassurance, especially in the context of concerns surrounding a Galaxy Digital-related entity reportedly selling part of its 80,000 BTC holdings, according to Nansen CEO Alex Svanevik.

Stablecoin demand in China also provides additional market sentiment insights. In a positive market, active retail trading typically causes stablecoins to trade at a premium of 2% or more compared to the official USD exchange rate. Conversely, when the market is tense, a discount larger than 0.5% usually indicates increasing panic, as traders rush to exit cryptocurrency positions for more stable assets.

Currently, Tether (USDT) is trading at a slight discount of around 0.5% in China, indicating that Bitcoin's recent price correction has not significantly impacted digital asset demand in the region. Even as Bitcoin set new highs, stablecoin inflow and outflow remained relatively stable over the past two weeks, reflecting a calm market sentiment.

Overall, Bitcoin traders seem more cautious about macro risks such as escalating global trade tensions or the risk of economic recession in the US – two factors that could trigger a broader risk-avoidance wave and pressure the crypto market.

However, the current indifference in the Bitcoin derivatives market is not a sign of any serious issues, but rather helps reinforce the $115,000 support zone as a potential short-term foundation.

This article is for general information purposes only and should not be considered as legal or investment advice.