Author: IOBC Capital

In the first half of 2025, the Crypto market was significantly influenced by multiple macro factors, with three key aspects being Trump administration's tariff policies, the Federal Reserve's interest rate policies, and geopolitical conflicts in the Russia-Ukraine and Middle East regions.

Looking ahead to the second half of the year, the Crypto market will continue to navigate through a complex and changing macro environment, with the following macro factors playing crucial roles:

I. Derivative Impact of Trump's Tariff Policies: Inflation Expectations

Tariffs are an important policy tool for Trump's administration, with the government expecting to achieve a series of economic goals through tariff negotiations: First, expand US exports and reduce trade barriers in other countries; second, maintain a 10%+ base tariff to increase US fiscal revenue; third, enhance the competitiveness of specific industries and stimulate the return of high-end manufacturing.

As of July 25, tariff negotiations with major global economies have made different levels of progress:

Japan: An agreement has been reached. US tariffs on Japanese goods have been reduced from 25% to 15% (including automotive tariffs), and Japan has promised to invest $55 billion in the US (covering semiconductors and AI), open automotive and agricultural markets, and increase US rice import quotas.

EU: The deadline is August 1. EU negotiation representatives arrived in the US on July 23 for final consultations, but the negotiation results have not been publicly disclosed.

China: The third round of trade negotiations will be held in Sweden from July 27 to 30. After the previous two rounds of negotiations, US tariffs on China have been reduced from 145% to 30%, and Chinese tariffs on the US from 125% to 10%. There are reports that the China-US tariff negotiation period may be extended by 90 days, and if no new agreement is reached in the third round of trade talks, tariff suspension may be rolled back.

Additionally, the US has reached tariff agreements with the Philippines and Indonesia. Currently, the most watched is the third round of tariff negotiations between China and the US. Although the uncertainty of tariff policies is gradually decreasing, the possibility of failing to make substantial progress in negotiations with key economic entities cannot be ruled out, which could lead to greater impacts on financial markets.

From an economic theory perspective, tariffs are a negative supply shock with a "stagflation" effect. In international trade, while enterprises are the taxpayers, they often transfer this tax burden to US domestic consumers through price transmission mechanisms. Therefore, it is expected that the US may experience a round of inflation in the second half of the year, which could significantly impact the Federal Reserve's interest rate reduction pace.

In summary, the impact of Trump's tariff policies on the US economy in the second half of the year may be characterized by a phased rise in inflation. Unless data indicates low inflation pressure, it will likely slow down the interest rate reduction pace.

II. Weak Dollar Phase of the Dollar Tide Cycle Favors the Crypto Market

The dollar tide cycle refers to the process of systematic outflow and inflow of the US dollar globally. Although the Federal Reserve did not lower interest rates in the first half of the year, the dollar index has weakened: falling from a high of 110 at the beginning of the year to 96.37, showing a clear "weak dollar" state.

The weakening of the dollar may have multiple reasons: First, the Trump administration's tariff policies have suppressed trade deficits, disrupted the dollar's circulation mechanism, and weakened the attractiveness of dollar assets, raising market concerns about the stability of the dollar system; second, fiscal deficits have dragged down credit, with continuous increases in US debt scale and repeated rises in US debt rates, deepening market doubts about fiscal sustainability; third, the petrodollar agreement has expired without renewal, and global central banks' dollar reserve proportion has dropped from 71% in 2000 to 57.7%, with gold reserve proportion increasing, triggering "de-dollarization" attempts. Additionally, the policy orientation reflected in the rumored "Mar-a-Lago Agreement" may have also played a boosting role.

Based on previous dollar tide cycles, the dollar index strength almost dominates the global liquidity trend. Global liquidity often follows a complete 4-5 year dollar tide cycle, showing a cyclical fluctuation pattern. Among these, the weak dollar cycle typically lasts 2-2.5 years, and if calculated from June 24, this weak dollar cycle may continue until mid-26.

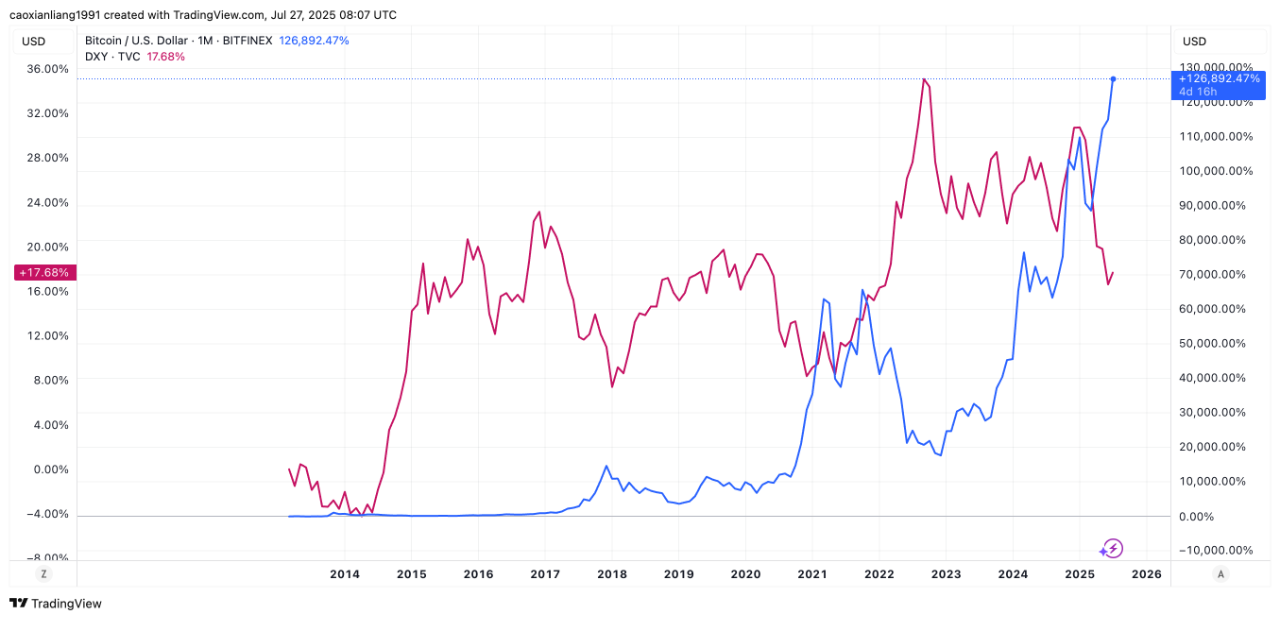

Graphic: IOBC Capital

As the graph shows, Bitcoin's trend often shows a negative correlation with the dollar index. When the dollar weakens, Bitcoin typically performs strongly. If the "weak dollar" cycle continues in the second half of the year, global liquidity will shift from tight to loose, continuing to benefit the crypto market.

III. Federal Reserve's Monetary Policy May Remain Cautious

There are four monetary policy meetings in the second half of 2025. According to the CME "Fed Watch" tool, there is a higher probability of 1-2 interest rate cuts. Among these, there is a 95.7% probability of maintaining the current interest rate in July, and a 60.3% probability of a 25 basis point cut in September.

Since Trump took office, he has repeatedly criticized the Federal Reserve's slow interest rate reduction pace on X platform, even directly blaming Fed Chair Powell and threatening to fire him, which has subjected the Federal Reserve to certain political intervention pressures. However, the Federal Reserve withstood the pressure and did not cut rates in the first half of the year.

According to the normal term arrangement, Fed Chair Powell will officially step down in May 2026. The Trump administration plans to announce the nominee for the new chair in December 2025 or January 2026. In this context, the voices of major dovish committee members within the Federal Reserve are gradually receiving market attention and are viewed as potential "shadow chair" influence. Nevertheless, the market generally believes that the July 30 monetary policy meeting will continue to maintain the current interest rate level.

Predictions for postponing rate cuts primarily have three core reasons:

1️⃣ Persistent inflation pressure - Influenced by Trump's tariff policies, US CPI rose 0.3% month-on-month in June, with core PCE inflation rising to 2.8% year-on-year. The tariff transmission effect is expected to further push up prices in the coming months. The Federal Reserve believes that the path to bringing inflation down to the 2% target is obstructed and requires more data confirmation;

2️⃣ Slowing economic growth - The 2025 growth is estimated at only 1.5%, but short-term data such as retail sales and consumer confidence have exceeded expectations, alleviating the urgency for immediate rate cuts;

3️⃣ Persistent job market resilience - Unemployment rate remains low at 4.1%, but corporate hiring is slowing down. The market predicts that unemployment rate might gradually rise in the second half of the year, with Q3 and Q4 forecasts at 4.3% and 4.4% respectively.

In summary, the probability of a rate cut on July 30, 2025, is extremely low.

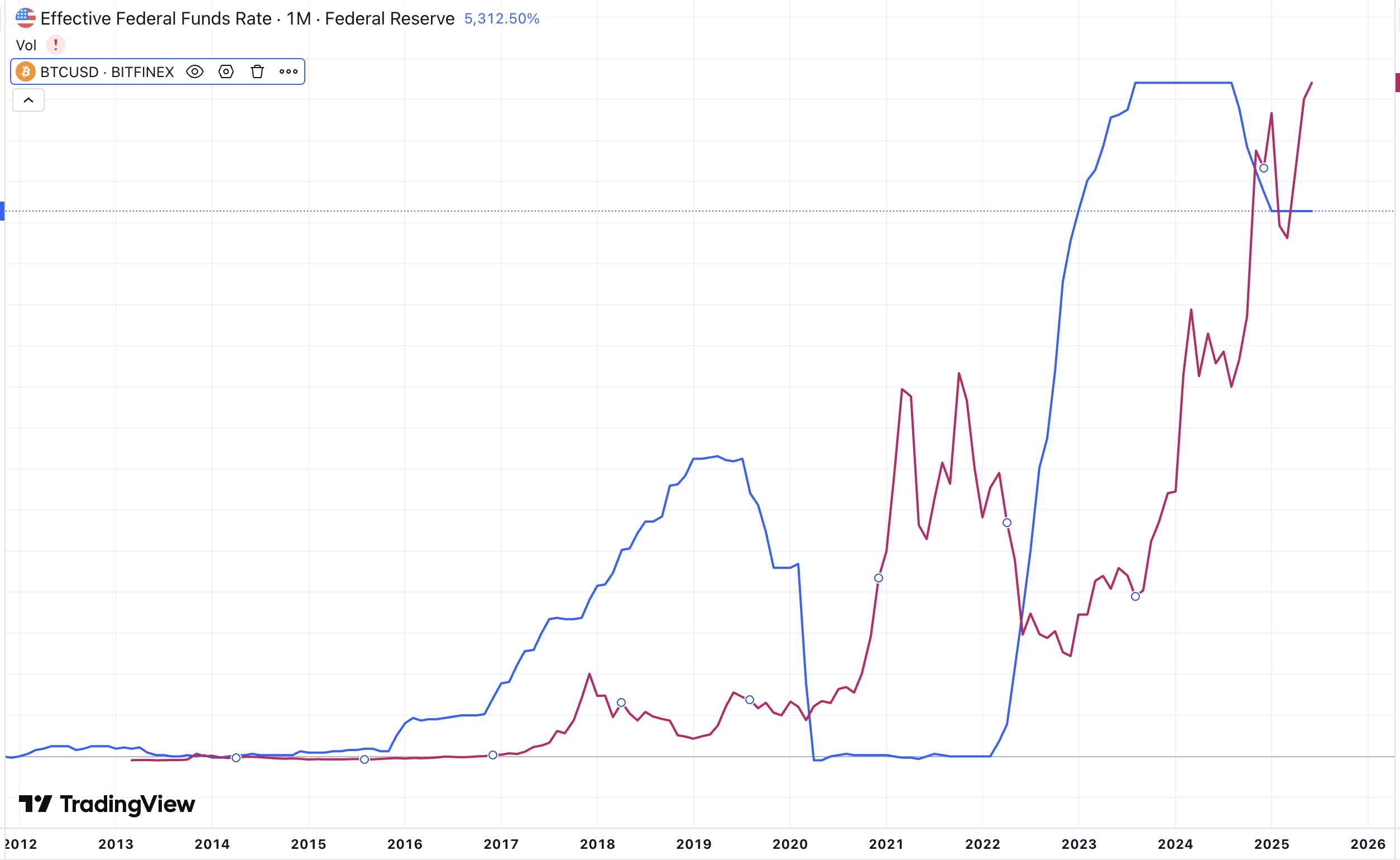

Graphic: IOBC Capital

In comprehensive terms, the Federal Reserve's monetary policy is expected to remain cautious, with potentially 1-2 rate cuts throughout the year. However, by observing the historical trends of Bitcoin and Federal Reserve interest rates, there is actually no significant correlation between the two. Compared to changes in Federal Reserve interest rates, the global liquidity under the weak dollar state might have a more significant impact on Bitcoin.

IV. Geopolitical Conflicts May Affect Crypto Market in the Short Term

The Russia-Ukraine war is currently in a stalemate, with dim prospects for diplomatic resolution. On July 14, Trump proposed a "50-day ceasefire deadline", stating that if Russia fails to reach a peace agreement with Ukraine within 50 days, the US will impose 100% and secondary tariffs, and provide military assistance to Ukraine through NATO, including "Patriot" air defense missiles. However, Russia has already assembled 160,000 elite troops, planning to focus on key fortresses in Ukraine's Donbas front line. Meanwhile, Ukraine has not been idle, conducting a large-scale drone attack on Moscow airport on July 21. Additionally, Russia announced its withdrawal from a thirty-year military cooperation agreement with Germany, completely rupturing Russo-European relations.

From the current situation, achieving a ceasefire by September 2 seems challenging. If a ceasefire is not reached, Trump's sanctions could potentially trigger market turbulence.

V. Crypto Regulatory Framework Takes Shape, Industry Enters Policy Honeymoon Period

The US GENIUS Act has been implemented in July 2025, stipulating that "no interest shall be paid to token holders, but reserve interest belongs to the issuer and its purpose must be disclosed". However, it does not prohibit issuers from sharing interest earnings with users, such as Coinbase's USDC with 12% annual yield. The restriction on paying interest to token holders limits the development of "yield-bearing stablecoins", originally intended to protect US banks and prevent trillions of dollars from flowing out of traditional bank deposits that support loans to businesses and consumers.

The US CLARITY Act clearly defines SEC regulation of security tokens and CFTC regulation of commodity tokens (such as BTC, ETH). It introduces the concept of a "mature blockchain system", enabling regulatory transition through certification - decentralized, open-source blockchain projects that run automatically based on preset rules can be certified (by submitting proof of no centralized control) and transition from "securities" to "commodities", with regulatory authority completely shifting to CFTC, and SEC losing its securities regulatory rights. Additionally, it provides partial exemptions for DeFi - activities like code writing, node operation, frontend interface provision, and non-custodial wallets are typically not considered financial services and are exempt from SEC regulation, only needing to comply with basic anti-fraud and anti-manipulation provisions.

Overall, the accelerated advancement of the GENIUS Act, CLARITY Act, and Anti-CBDC Surveillance State Act marks the US crypto regulation moving from a "regulatory ambiguity" phase to a "sunshine regulation" era. It also reflects the policy intent of "maintaining the US dollar's global trade currency status". As the regulatory framework gradually improves, the stablecoin market scale is expected to expand further, with compliant stablecoin projects and DeFi protocols set to benefit.

VI. "Coin-Stock Strategy" Activates Market Enthusiasm, Sustainability Remains to be Observed

As MicroStrategy completes an epic transformation with its "Bitcoin strategy", a crypto asset reserve revolution led by listed companies is sweeping the capital markets. From ETH to BNB, SOL, XRP, DOGE, HPYE, TRX, LTC, TAO, FET, and over a dozen mainstream Altcoins have become new anchors for corporate treasuries, with this "coin-stock strategy" becoming this year's market trend.

[The rest of the translation follows the same professional and accurate approach, maintaining the technical and financial terminology as specified.]