BitMine, a crypto asset company led by a Wall Street legendary strategist, has loaded 560,000 ETH into its strategic reserve, becoming one of the most ambitious institutional ETH holders in the Ethereum ecosystem.

On the afternoon of July 28 Beijing time, Ethereum (ETH) price broke through the $3,940 mark, creating a new high in 2025, with a surge of 51% since the beginning of the year, far exceeding Bitcoin's 12% increase during the same period. This price is just a step away from the 2024 high of $4,100 and has only about 22% of upside potential from the historical high of $4,800 set in 2021.

The core driving force behind Ethereum's strong rise comes from Wall Street's strategic reassessment of blockchain infrastructure. Over the past two weeks, large Ethereum investors have increased their holdings by over 500,000 ETH, with the total ETH balance on exchanges decreasing by 317,000, showing strong confidence in holding. Institutions like BlackRock have invested $406 million in Ethereum, pushing the spot Ethereum ETF's weekly inflow to a historical record of $2.18 billion.

Wall Street's "Oracle": From Bitcoin Evangelist to Ethereum Strategist

Behind Ethereum's breakthrough, the strategic layout of Wall Street legendary analyst Tom Lee is particularly noteworthy. This Wharton School graduate of Korean descent has spanned the intersection of traditional finance and crypto revolution throughout his career.

As a former chief equity strategist at JPMorgan Chase, Lee caused a stir on Wall Street in 2002 by insisting on publishing a bearish report on Nextel. Despite facing pressure from company executives, his data-driven research style was confirmed after an internal investigation, and this incident even became a landmark case for the Wall Street Journal to discuss analyst independence.

After leaving JPMorgan Chase in 2014, Lee founded Fundstrat Global Advisors, becoming the first Wall Street strategist to incorporate Bitcoin into mainstream valuation models. In 2017, he released a research report "Valuation Framework for Bitcoin as a Gold Alternative", pioneering linking Bitcoin's value to macroeconomic indicators such as money supply growth and gold substitution rate, predicting Bitcoin would reach a value center of $20,300 in 2022.

When global markets crashed due to the pandemic in March 2020, Lee was one of the earliest strategists to predict a "V-shaped recovery". He even suggested on a CNBC program in 2019 that ordinary investors allocate 1%-2% of assets to Bitcoin, and when the host exclaimed "this sounds a bit crazy", the video clip widely circulated in the crypto community became his highlight moment as a Bitcoin evangelist.

Strategic Transformation: Leading BitMine to Build Ethereum Whale Reserve

BMNR stock price rose from $3.92 to a high of $161

In June 2025, Lee's crypto strategy reached a key breakthrough. He was appointed chairman of the board for Bitcoin mining company BitMine Immersion Technologies (Nasdaq: BMNR), driving the company's strategic transformation from traditional mining to enterprise-level Ethereum reserve structure.

Under Lee's leadership, BitMine completed a milestone capital operation:

- Issued 55 million shares through private placement at $4.50 per share, raising $250 million in dedicated funds for building ETH fiscal reserves

- Submitted S-3ASR automatic registration statement, launching an ATM plan of up to $2 billion

- Attracted top crypto investment institutions like Founders Fund, Pantera, and Galaxy Digital

The implementation speed was shocking. By mid-July, BitMine disclosed ETH holdings of 300,657, with a market value exceeding $1 billion; by late July, holdings soared to 566,776 ETH, with market value breaking $2 billion, becoming one of the global companies holding the most ETH.

"Our goal is to acquire and stake 5% of Ethereum's total supply," Lee revealed in an interview. Based on the current circulation of 120 million ETH, this target means a strategic reserve of 6 million ETH, worth over $24 billion.

Stablecoins: Igniting Ethereum's "ChatGPT Moment"

In Lee's view, the deep driving force behind Ethereum breaking historical highs comes from the stablecoin's "ChatGPT moment" - a turning point that will reshape global financial infrastructure.

This judgment is based on solid on-chain data support:

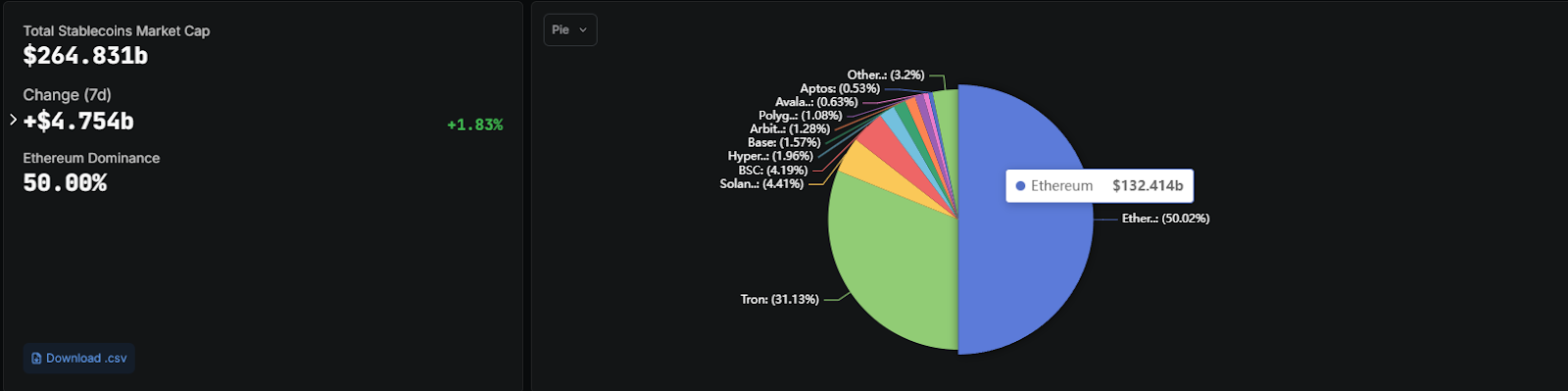

- Global stablecoin market value has exceeded $264.8 billion, with over 50% of issuance occurring on the Ethereum network

- Ethereum carries about 30% of stablecoin transaction fees and over 60% of tokenized real-world assets (RWA)

- Traditional financial institutions like JPMorgan Chase and Robinhood have chosen Ethereum as their underlying chain for tokenization businesses

The attitude change of US policymakers became a key catalyst. The GENIUS Act passed on July 18 provided a clear federal regulatory framework for stablecoins, and former Treasury Secretary Yellen even predicted the stablecoin market size would surge from the current $250 billion to $2 trillion.

"If stablecoin creation increases 10-fold, it will cause Ethereum transaction fees to grow exponentially," Lee pointed out in a Fundstrat research report. This judgment reveals Ethereum's value capture mechanism as the underlying infrastructure for the stablecoin ecosystem - network effects will continuously strengthen as the scale of financial assets on-chain expands.

Treasury Strategy: Five Leverages to Pry Open Ethereum's Value

Compared to traditional ETFs or on-chain holdings, Lee designed a five-structure advantage for BitMine's Ethereum treasury model:

- Reflexive growth mechanism: When stock price is higher than net asset value, purchase more ETH by issuing shares, achieving cyclic growth of net asset value per share

- Zero-cost position building capability: Hedge volatility through convertible bonds, options, etc., significantly reducing capital costs

- Merger and acquisition arbitrage space: Can acquire other Ethereum treasury companies, amplifying net asset value leverage

- Cash flow expansion capability: Develop ETH staking, DeFi yield and other operational businesses to create continuous cash flow

- Sovereign put option: When ETH holdings occupy a core position in the ecosystem, it may become a strategic asset prioritized for acquisition by financial institutions

This model has sparked a frenzy in the capital market. BitMine's stock price has surged over 3000% since late June, with market value peaking at $18 billion. However, Lee also warned of risks: "A similar strategy by SharpLink Gaming soared 4000% after financing but then plummeted 90%, investors should be wary of short-term speculative risks."

Compared to traditional investment tools, this model provides a richer value capture path. When institutions like Goldman Sachs need to issue stablecoins on Ethereum, they may be more inclined to acquire treasury companies that already have large ETH staking rights, rather than directly buying ETH from the market. This "structural call option" gives treasury companies a unique strategic premium.

Ecological Explosion: Dual-Driven by Layer 2 and Institutional Adoption

The technical support for Ethereum's price breakthrough comes from substantial progress in its ecosystem. The Pectra upgrade completed in 2025 optimized validator experience, and the subsequent Verkle Trees significantly improved state storage efficiency. The Dencun upgrade to the Ethereum mainnet is less than a month away, which is expected to significantly reduce transaction costs and address key scalability challenges.

The explosion of the Layer 2 ecosystem provides another growth engine:

- Platforms like Arbitrum and Optimism have seen surging transaction volumes and TVL

- DeFi loan scale skyrocketed by 43% to $23.9 billion

- Stablecoin supply reached a historical high of $137.4 billion

- EigenLayer's restaking protocol TVL soared to $11.3 billion

In terms of institutional adoption, Ethereum has become Wall Street's most favored blockchain infrastructure. Tom Lee noted: "Wall Street is looking for a chain that can carry real-world assets and comply with regulations, and Ethereum is becoming that convergence point." This positioning gives Ethereum an irreplaceable position in the fusion of traditional finance and the crypto world.

Price Target Speculation: Imagination Space from $4,000 to $15,000

As Ethereum breaks through $3,940, market expectations for its price prospects quickly heated up. Mark Newton, Fundstrat's technical strategy head, provided a clear target: reaching $4,000 by the end of July, an additional 2% increase from the current price.

Technical indicators show that Ethereum is in a strong upward channel:

- Relative Strength Index (RSI) reached 84.74, entering the overbought zone

- MACD indicator rebounded to its highest point since December 2023, sending a strong bullish signal

- Deribit exchange call option buying volume surged, with call/put option ratio reaching a six-month peak

Wave theory analysis shows that Ethereum is currently in the third wave of ascent, with a target price around $4,400; after breaking through, the fifth wave could challenge $6,000.

Lee's prediction is even more aggressive. He clearly stated: "If current on-chain and market data continue to be favorable, ETH might even challenge the $10,000 to $15,000 range by the end of the year." The path to this target is deeply linked to the expansion of the stablecoin market - when stablecoins move from $250 billion to $2 trillion, Ethereum's value as the primary settlement layer will experience exponential enhancement.

Despite market enthusiasm, technical indicators have already issued warning signals. The Relative Strength Index (RSI) at 84.74 is significantly above the 70 overbought warning line, indicating accumulated short-term pullback risk. Analyst Captain Faibik warns investors that if the $4,000 resistance zone is not broken, a technical correction may occur.

There are also regulatory concerns. Although the GENIUS Act provides a federal regulatory framework for stablecoins, the SEC's determination of Ethereum's security status remains uncertain. When asked about regulatory risks, Lee referenced his 2002 Nextel experience: "I cannot refute critics. The stock market doesn't care about my opinion, so I can only try to understand what the market is saying."

This judgment based on data rather than emotion may be the secret to Lee's thirty-year resilience on Wall Street. From the internet bubble to the global financial crisis, he candidly admits to early underestimating credit market risks: "Once the credit market loses confidence, no financial market can remain unscathed." This reverence for systemic risks keeps him clear-headed amid crypto market frenzy.

Conclusion

As Ethereum stabilizes above $3,900, the fusion of Wall Street and the crypto world enters a new stage. Tom Lee's BitMine strategy transformation has made this former Bitcoin mining company hold over 560,000 ETH, becoming a crucial institutional token holder in the Ethereum ecosystem.

The expansion of the stablecoin market towards a $2 trillion scale, and Ethereum's irreplaceability as the primary settlement layer, are building solid fundamental support.

"Configuring ETH at the current price is an effective path for corporate finance to obtain 10x potential," Lee's judgment is being verified by an increasing number of traditional financial institutions. When the "ChatGPT moment" of stablecoins meets the blockchain's financial infrastructure revolution, Ethereum's trillion-dollar market value journey may have just begun.