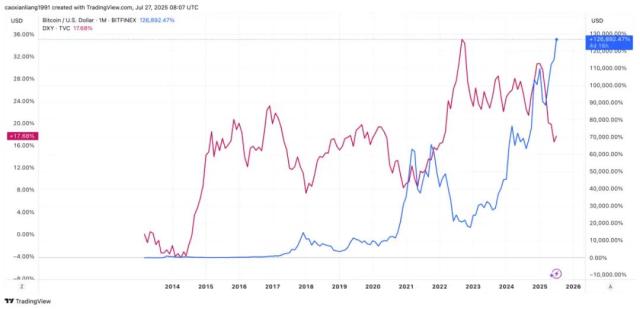

On January 3, 2009, the Genesis Block of Bitcoin was successfully mined, marking the first application of blockchain technology in the decentralized digital currency domain, and the Bitcoin network was officially launched. Over the subsequent decade, although Bitcoin and its led cryptocurrency market demonstrated a significant long-term bullish trend, this journey was far from smooth. Its price trend exhibited intense and distinctly cyclical fluctuations, experiencing multiple transitions from heated bull markets to deep bear markets. These fluctuations were not random but closely linked to a series of core events profoundly influencing market patterns.

Looking at Bitcoin's price trend from 2009 to 2025 (data source: The Block), it can be clearly divided into six major development stages based on its price range and variation trends. The landmark events of each stage and their far-reaching impacts on industry ecology are as follows:

Reviewing Bitcoin's price trend from 2009 to 2024, it demonstrates significant cyclicality. According to Bitcoin's price range and price variation trends, it can be divided into six major development stages. The landmark events of each stage and their profound influences shaping industry ecology are detailed below:

Stage One (2009-2016): Initial Market Exploration and Technological Foundation

At its birth, Bitcoin was merely a niche plaything in the geek circle and an experimental ground for cryptography enthusiasts. From 2009 to early 2013, its price remained consistently low. However, entering 2013, Bitcoin's price experienced its first violent fluctuation, surging from around $20 at the beginning of the year to over $1,100 by year-end, before subsequently sharply declining. This roller coaster-like market trend first pushed Bitcoin into the global spotlight.

Source: CoinGecko

Why did Bitcoin's price suddenly surge in 2013? The driving factors behind this were as follows:

1. Cyprus Bank Crisis Ignites Hedging Demand

In March 2013, the Cyprus government announced a tax on bank deposits to secure international aid. This radical measure triggered strong public protests, bank runs, and market volatility, profoundly exposing the fragility of the traditional financial system and potential risks of government decisions.

[The translation continues in this manner, maintaining the original structure and translating all text while preserving the <> tags and their contents.]- For project parties, ICO provides a financing channel that bypasses the strict review of traditional IPO, allowing fund-raising with only basic technical documentation while avoiding equity dilution issues;

- For ordinary investors, the low threshold for participating in early-stage projects and obtaining short-term premium returns after token listing constitutes a strong speculative motivation.

However, market expansion is accompanied by the accumulation of systemic risks. ICO projects generally lack information disclosure mechanisms and qualification review standards, with no clear norms for fundraising scale and circulation methods. In an environment of regulatory absence, financing scope has disorderly expanded from blockchain core technology development to fields such as Internet of Things, gambling, and social media. More critically, the technical security risks of smart contracts continue to be exposed, further amplifying market risks.

Regulatory Crackdown and Market Turning Point

Addressing these chaotic phenomena, on September 4, 2017, the People's Bank of China, jointly with seven ministries, issued a "Announcement on Preventing Risks of Token Issuance Financing", explicitly defining ICO as an illegal public financing behavior. The ban required domestic cryptocurrency exchanges to completely cease trading and close platforms by September 15, directly causing a cliff-like drop in virtual currency market trading volume, with Bitcoin prices simultaneously showing a significant decline. This regulatory action marked a transformation in the global governance paradigm of decentralized financing.

Stage Characteristics: In the second stage, we can see that Ethereum's technological innovation drove explosive market growth. However, the lack of macro regulation led to risk accumulation, revealing the bidirectional action of macro motivational mechanisms - technology and innovation provide market growth momentum, while regulatory system reconstruction guides market correction direction.

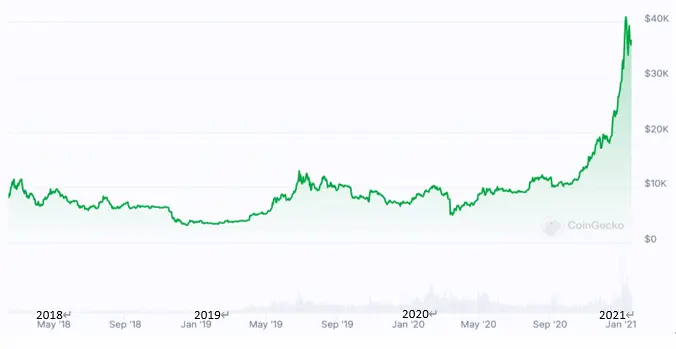

Third Stage (2018-2020): Market Clearing and Institutional Breakthrough

Source: CoinGecko

Deep Callback and Market Clearing

After experiencing the 2017 ICO bubble burst, the Bitcoin market entered a deep callback cycle in 2018, accompanied by numerous project bankruptcies and continuous price pressure. By early 2020, Bitcoin prices remained oscillating in the $10,000 range. The core turning point of this stage was the entry of traditional capital and compliant institutions, which built the foundation for a new bull market, ultimately triggering the DeFi innovation wave in summer 2020.

Institutional Entry

On June 18, 2019, Facebook officially released the Libra stablecoin white paper, attempting to construct a global digital currency payment network. This disruptive challenge to the traditional financial system was ultimately shelved due to global regulatory agencies' political encirclement.

On January 21, 2020, Grayscale Bitcoin Trust completed SEC registration, becoming the first SEC-regulated cryptocurrency investment tool. The company's general manager Michael Sonnenshein emphasized: "Grayscale voluntarily accepts this appointment and will continue to work within the existing regulatory framework. Today's statement should signal to investors that our regulators are willing to engage with our products and the entire (cryptocurrency) industry." This move provided a compliant entry channel for institutional capital, significantly lowering allocation thresholds.

On August 11, 2020, MicroStrategy purchased 21,454 bitcoins for $250 million. Today (2025), MicroStrategy has become one of the world's largest publicly held Bitcoin companies. MicroStrategy's Bitcoin purchasing strategy completely transformed corporate financial management thinking and changed the entire industry's attitude towards digital assets.

Stage Characteristics: The third stage was a critical period of market self-repair and transformation. During the bear market following the ICO bubble burst, inferior projects were washed out. The entry of real-world institutions provided a path of institutionalization for the crypto market, paving the way for the next stage's market explosion.

In November 2022, the FTX exchange's bankruptcy triggered a crisis of trust in exchanges, becoming a black swan event that crushed market confidence. Since then, the market has raised higher requirements for exchange transparency and trust, driving industry reflection and improvement.

Stage Characteristics: A series of black swan events exposed issues in risk management, transparency, and governance. The market entered a bear market, forcing a painful but necessary market cleansing and promoting industry-wide reflection and upgrades in safety, transparency, and regulatory compliance.

Stage Six (2024-2025): Institutional Breakthrough and Macro Narrative Resonance

Source: CoinGecko

Market Recovery and Historic Breakthrough

Driven by regulatory compliance and monetary policy shifts, the cryptocurrency market achieved a historic breakthrough in 2024. Bitcoin's price broke through the $100,000 mark for the first time, Ethereum significantly improved Layer 2 scalability through the Cancun upgrade, and the MEME Coins sector simultaneously experienced explosive growth.

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved 11 BTC spot ETFs, with massive funds from traditional institutions entering the crypto market, further promoting compliant development.

In September 2024, the Federal Reserve cut interest rates by 50 basis points for the first time in 4 years, which encouraged traditional market funds to shift towards high-risk assets and injected significant liquidity into the crypto market.

In November 2024, Trump was elected U.S. President, and his openly supportive stance on cryptocurrencies drove Bitcoin's price to break $100,000.

Stage Characteristics: Institutional breakthroughs resonated with macro policies and political narratives, driving the market into a new growth cycle led by institutions and becoming more compliant.

Summary

Through Bitcoin's multiple price growth cycles, we can glimpse the operational patterns of the cryptocurrency market, which follows a cyclical characteristic of "technological innovation explosion → market speculative frenzy → regulatory intervention → deep market correction → underlying technological iteration". The factors influencing the market are diverse and interconnected, with core factors including:

- Technological Innovation and Ecosystem Development: Continuously expanding application scenarios like Ethereum smart contracts, DeFi protocols, Non-Fungible Tokens, and GameFi are key drivers attracting funds and users. Bitcoin's halving every four years has long supported price upward expectations by reducing supply.

- Market Sentiment and Speculative Drivers: The emergence of new narratives, technological and ecosystem development, accompanied by price increases, amplified users' FOMO emotions, triggering speculative frenzies and driving price increases.

- Regulatory Policies and Compliance Process: Policy changes like China's ICO ban, El Salvador making BTC legal tender, and the U.S. approving BTC futures and spot ETFs directly impacted market confidence and capital flow. Strict regulation suppresses the market short-term but ultimately clears obstacles for large-scale institutional capital entry, promoting market standardization and mainstreaming.

- Institutional and Capital Entry: Channels like Grayscale Trust, MicroStrategy, and spot ETFs lowered traditional capital entry barriers, and their large-scale influx provided market stability endorsement and continuous liquidity.

- Macro Economic and Political Environment: Global monetary policies, geopolitical risks, major political events, and leadership policy tendencies significantly amplify market volatility, with cryptocurrencies increasingly demonstrating potential as macro hedging tools.

- Black Swan Events and Market Correction: Incidents like Mt. Gox collapse, LUNA crash, and FTX bankruptcy triggered trust crises and bear market pullbacks. However, these crises prompted market reflection, eliminated inferior projects, and promoted improvements in safety, transparency, and governance standards, laying the foundation for the next healthy development.

Meanwhile, we can observe:

- The cryptocurrency market follows a spiral cycle, with each cycle eliminating inferior projects and ecosystems while precipitating quality value.

- Blockchain technology breakthroughs and ecosystem expansion are the core engines of long-term value growth in the cryptocurrency market.

- Regulatory policies are a double-edged sword, and the ultimate compliance process (like spot ETFs) is the necessary path to attracting institutional capital and achieving mainstreaming, marking a leap in market maturity.

- Global macro economics, monetary policies, and geopolitics increasingly influence crypto market volatility, strengthening its macro attributes as a new asset class.

- Although black swan events cause short-term pain, they objectively accelerate industry standardization in safety, transparency, and governance.

Standing at the starting point of a new cycle in 2025, Real World Asset (RWA) tokenization, as a bridge connecting traditional finance and on-chain ecology, is emerging, suggesting that market focus may shift from speculative frenzy to more substantive value creation. In the foreseeable future, the cryptocurrency market will enter a new era of dual-wheel growth driven by institutional innovation and continuous technological breakthroughs!