Author: Dr.PR

While the current market is generally focused on "when will interest rates be cut", what is truly worth paying attention to is: the Federal Reserve maintaining high interest rates unchanged may actually be more beneficial to U.S. stocks and the crypto market in the long term. Although this view seems counterintuitive, historical experience, fundamental structure, and fiscal-driven implicit easing all point to the same direction.

I. High Interest Rates ≠ Bear Market: History Tells Us That Structural Bull Markets Are Often Born in High Interest Rate Environments

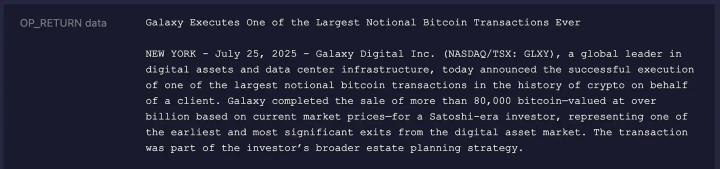

Federal Reserve Federal Funds Rate vs. S&P 500 (circa 1994–2000)

Taking 1994 to 2000 as an example, the Federal Reserve raised the federal funds rate from around 3% to 6% in 1994. After this rate hike cycle, U.S. stocks ushered in one of the strongest tech bull markets in history:

The S&P 500 rose from around 470 points to a high of 1500 points in 2000;

The Nasdaq had an annualized return of over 25% between 1995-2000, driving a substantial profit cycle before the "internet bubble";

Corporate earnings, technological innovation, and investment returns became the dominant factors, not monetary easing itself.

This means that as long as the economy does not experience a hard landing, high interest rates are not the culprit suppressing the stock market.

II. The Essence of Current "No Rate Cut" Is Confidence in the Economy

As of July 2025, the Federal Reserve's federal funds target rate range is 4.25%-4.50%. Although it has not significantly relaxed, the important thing is - it has not raised rates again.

What this reflects is the reality of a "soft landing being realized":

Core PCE inflation dropped from a high of 5.4% in 2022 to the 2.6%-2.7% range by mid-2025;

GDP growth remains between 1.5%-3% annually;

Unemployment rate remains stable at 4.1%, with robust labor market resilience;

U.S. stock overall EPS expectation for 2025 is in the 250-265 range, with profitability recovering.

In other words, the essence of not cutting rates is that the Federal Reserve believes there is no need to rescue the market, as the market is self-repairing.

III. The Real "Easing" Is Being Driven by Fiscal Policy Rather Than Monetary Policy

Despite unchanged nominal interest rates, the overall macroeconomic liquidity structure in the United States has shifted to a "fiscally-led stimulus".

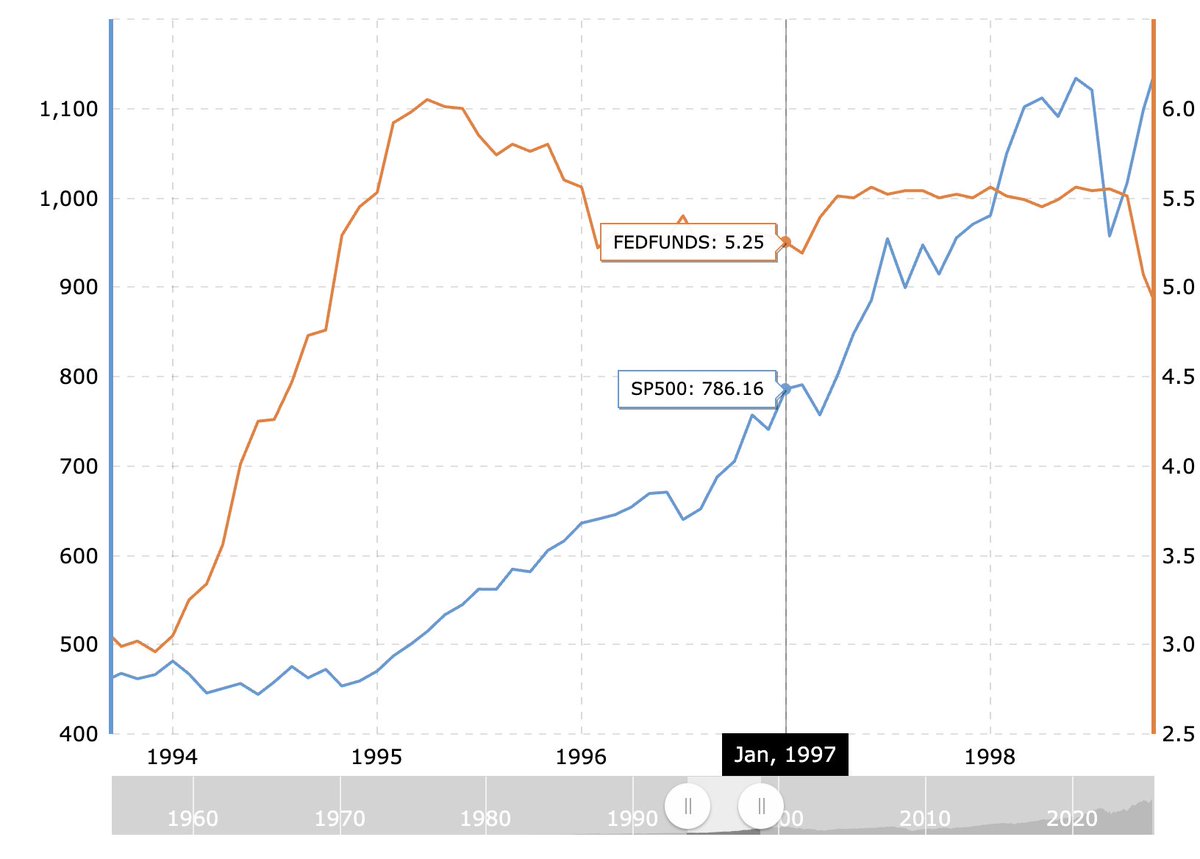

Annual Growth Trend of U.S. Federal Debt

The U.S. fiscal deficit as a percentage of GDP in 2024 exceeds 6.4%, one of the highest in the post-war period;

As of July 2025, the total U.S. federal debt has exceeded $36.7 trillion;

The net Treasury issuance scale in Q3 2025 is expected to exceed $1 trillion;

The "Big Beautiful Bill" led by the Trump camp, containing large-scale tax cuts and industrial subsidies, is expected to increase fiscal deficit by about $3 trillion over 10 years.

Even if the Federal Reserve remains inactive, such fiscal spending is constituting a de facto "hidden liquidity injection".

IV. High Interest Rates Purify Market Structure, Reinforcing the "Strong Get Stronger" Logic

The high-interest-rate environment, while increasing financing difficulties, is actually "favorable" for large companies:

Apple holds over $130 billion in cash, Alphabet over $90 billion, and Meta nearly $70 billion;

At 4%-5% interest rates, these cash holdings themselves generate billions of dollars in interest income;

Small and medium-sized enterprises are marginalized in financing costs, with market share further concentrating to giants;

High cash flow buybacks drive EPS upward, with more stable valuation structures.

This not only explains why the "seven tech stocks" still dominate the market cap rankings, but also why index assets continue to reach new highs despite high interest rates.

V. Crypto Market: From Speculative Game to Structural Allocation Asset

Crypto assets were once viewed as "speculative products born from zero interest rates", but over the past two years in a high-interest-rate environment, the market structure has undergone profound changes:

1) ETH/BTC Become Allocation Targets for "Digital Cash Flow" and "Digital Gold"

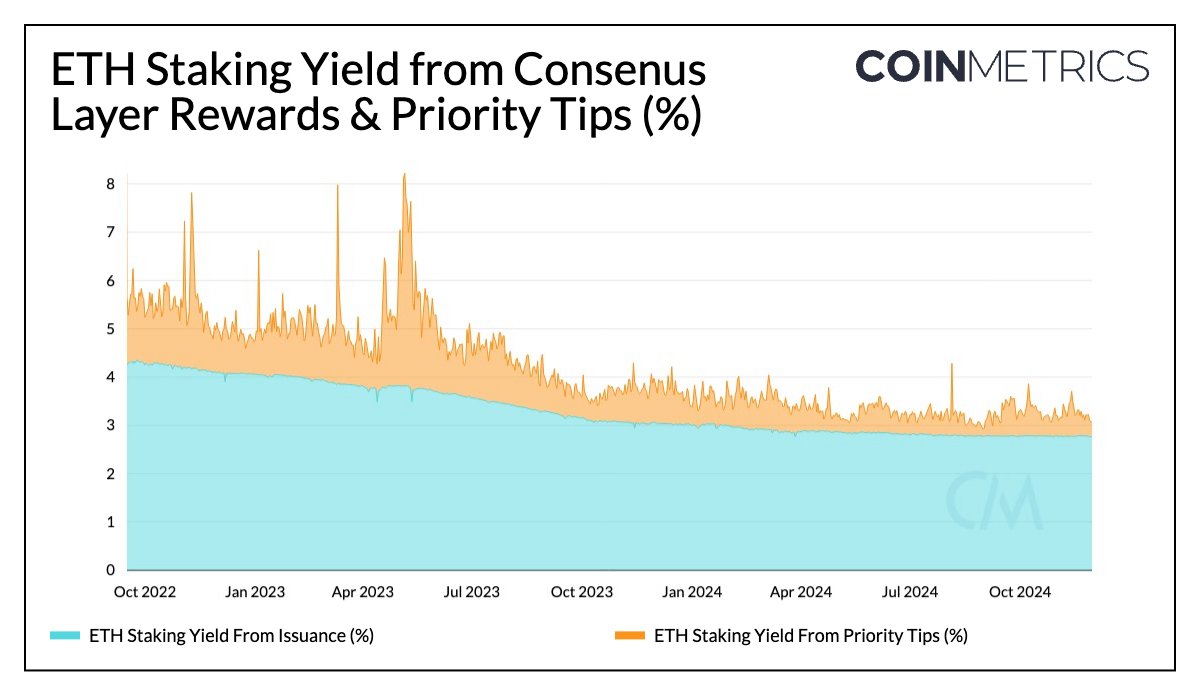

Ethereum ETH Staking Yield Trend (Annualized)

Ethereum staking annualized yield remains between 3.5%-4.5%, possessing quasi-government bond attributes;

BTC has become a core reserve asset in multiple U.S. listed companies (such as MicroStrategy);

ETF launch, re-staking mechanisms, and on-chain governance financial yields have made ETH present a combination of "stable returns + asset scarcity".

2) Stablecoin "Interest Spread Dividend" Becomes a Hidden Profit Pool

Circle earned over $1.7 billion in profits from U.S. Treasury interest in 2024;

Tether earned over $4 billion in revenue through reserve fund investments in the past year;

The stablecoin ecosystem has actually enhanced profitability under high interest rates, strengthening the entire DeFi infrastructure's stability.

3) Crypto Market's Survival Logic Shifts to "Cash Flow" and "Systemic Returns"

Speculative altcoins and meme coins recede;

Projects with clear revenue models like Uniswap, EigenLayer, and Lido gain capital favor;

The market begins to assess on-chain assets using "ROE, cash flow, and inflation resistance".

The crypto market is completing a transition from "storytelling" to "structural storytelling".

VI. Conclusion: This Is a Reassessment of Asset Logic, Not a Cycle of Macroeconomic Liquidity Injection

While rate cuts can certainly boost asset prices, without establishing them on the foundation of real profitability and structural optimization, they will ultimately repeat the bubble burst after 2021.

This time, U.S. stocks and the crypto market are taking a healthier path:

High rates but controlled inflation;

Continuous fiscal stimulus, corporate profit recovery;

Strong companies gain cash flow advantages;

Crypto assets return to economic model competition.

A true slow bull market is not driven by a money printer, but by structural reallocation leveraged by pricing mechanisms and cash flow.

The Federal Reserve's current "inaction" is precisely the most critical background for this structural reassessment to occur.