Deloitte's survey shows that 99% of CFOs at billion-dollar corporations expect to use crypto assets, signaling a strategic shift towards digital assets.

A survey published by Deloitte in Q2/2025 reveals that 99% of Chief Financial Officers (CFOs) at enterprises with revenues over $1 billion expect to use crypto assets in long-term business operations. This is a clear signal of a strategic shift quietly taking place, as digital assets, once viewed as a marginal investment channel, are gradually becoming a strategic focus in the boardrooms of the world's top corporations.

The question is no longer "whether to participate?" but "when to deploy?". Around 23% of CFOs surveyed indicated that their treasury departments plan to adopt crypto assets for investment or payment purposes within the next two years. This percentage rises to nearly 40% for enterprises with revenues over $10 billion, showing that large corporations are the primary driving force behind this trend.

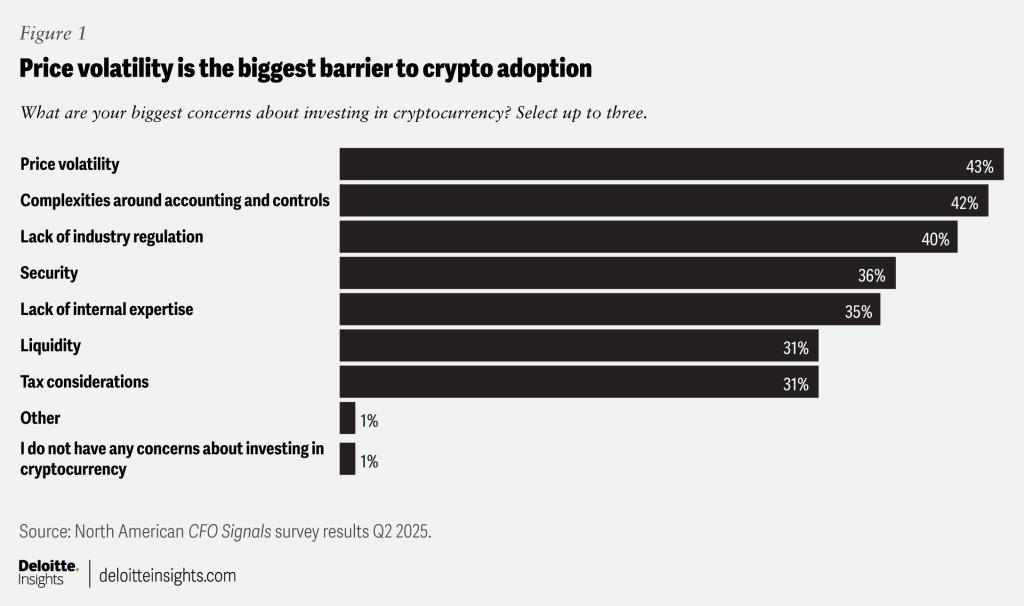

However, an optimistic outlook does not mean the deployment path will be smooth. CFOs still demonstrate a cautious attitude. The three major challenges identified include: price volatility of assets like Bitcoin and Ether (43%), difficulties in accounting (42%), and an uncertain legal environment - especially in the US (40%).

Nevertheless, many businesses are preparing to act. 15% of CFOs said they plan to directly invest in volatile crypto assets within the next 24 months, a percentage that increases to 24% in large-scale enterprises. In the same period, about 15% of businesses expect to accept payments in stablecoins - with two main drivers being: enhancing customer privacy protection (45%) and optimizing costs for cross-border transactions (39%).

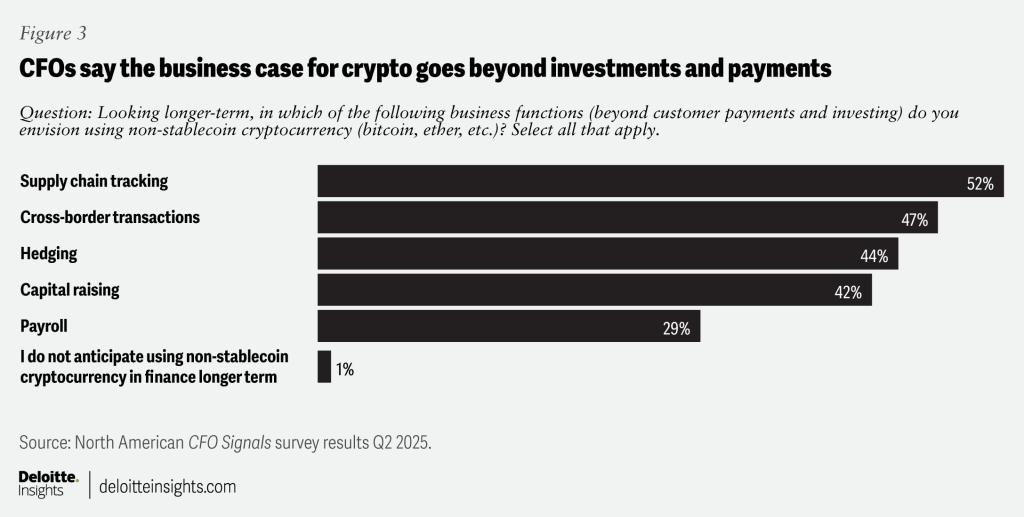

Digital assets are also moving beyond the financial realm to become a cross-industry strategic discussion topic. More than half of the CFOs surveyed are actively evaluating the potential of blockchain-based assets to enhance operational efficiency - especially in supply chain management and origin traceability. 37% of CFOs have introduced this topic in board discussions, 41% with investment directors, and only 2% admit to never having had any internal conversations related to crypto assets.

Survey results from Coinbase in collaboration with EY-Parthenon also reinforce this trend: 83% of institutional investors indicate they will increase their crypto asset investment proportion in 2025. A new wave of capital is forecast to flow into the market, focusing not only on Bitcoin and Ether but also expanding to assets like XRP, Solana, and many other tokens with practical applications.