Bitcoin mining difficulty has reached an All-Time-High of 127.6 trillion in August 2025. This movement reflects the continuous expansion of global computing power, ensuring network security.

However, despite increasing technical challenges, Miners' profits are quietly rising, a rare momentum that analysts believe could signal a new phase in the Bitcoin (BTC) market cycle.

Bitcoin Mining Difficulty Reaches Record High

The next mining difficulty adjustment, expected on 08/09, is predicted to slightly reduce this index to around 124.71 trillion.

Bitcoin Mining Difficulty. Source: Coinwarz

Bitcoin Mining Difficulty. Source: CoinwarzThis adjustment aims to bring the average Block time back to the 10-minute target, reducing from the current 10 minutes and 23 seconds.

These periodic adjustments are fundamental to Bitcoin's design. They maintain consistent issuance and network stability despite Hash Rate fluctuations.

Interestingly, the higher Bitcoin mining difficulty does not reduce Miners' profit margins.

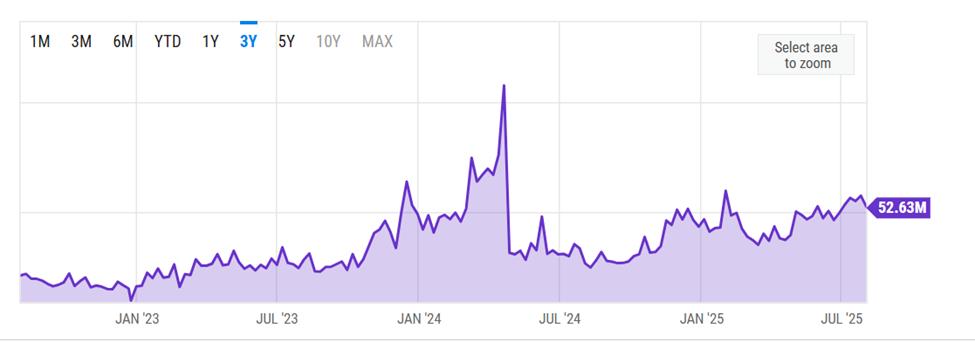

On the contrary, network data shows Miners' revenue peaked after halving at $52.63 million per exahash daily.

Bitcoin Miners' Revenue. Source: ycharts.com

Bitcoin Miners' Revenue. Source: ycharts.com"Bitcoin Miners' daily revenue is currently at $52.63 million, down from $56.35 million yesterday and up from $25.64 million a year ago. This represents a -6.61% change from yesterday and 105.3% from a year ago," analysts at ychart.com reported.

This is a strong signal, especially with rising energy costs and an increasingly competitive mining environment.

In a recent post, Blockware Intelligence, a Bitcoin mining analysis company, highlighted this difference.

"Bitcoin mining price case? BTC/USD rising faster than mining difficulty. In the past 12 months: > BTC/USD +75% > Mining difficulty: +53%. Bitcoin Miners' profit margins are increasing," the company said in a recent post.

Increasing Profit Margins Signal Positive Shift

History shows such momentum, where Bitcoin price rises faster than mining difficulty, occurred in the early stages of bullish market cycles. Similar patterns were observed in 2016 and mid-2020, before significant price increases.

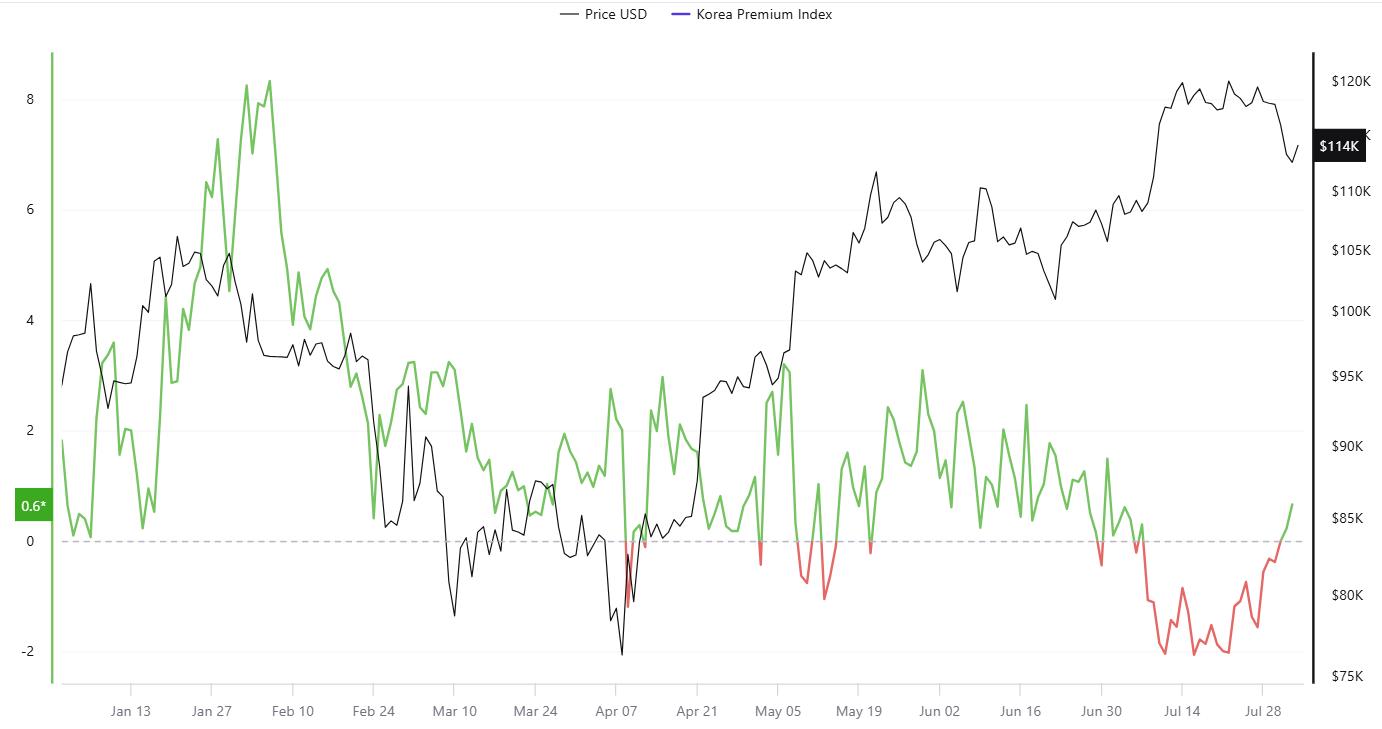

The increasing profits also reflect deeper demand dynamics, with data showing the current Kimchi premium in South Korea at +0.6%. Notably, this indicates strong regional interest in BTC.

South Korean Kimchi Premium. Source: CryptoQuant

South Korean Kimchi Premium. Source: CryptoQuantKimchi premium represents the price difference between local exchanges and the global spot market.

This, along with the deployment of more efficient ASIC machines and increasing institutional mining investments, suggests a healthy mining sector and optimism about Bitcoin's medium-term trend.

Beyond Miners' profit margins, Bitcoin's scarcity story remains intact. With over 94% of the total 21 million BTC mined, the stock-to-flow ratio of this pioneering cryptocurrency is currently around 120, double that of gold.

This long-term scarcity positions Bitcoin as an inflation hedge and a hedge against monetary decline, even as short-term price action remains subdued.

However, the broader market has yet to price in the improving on-chain fundamentals. After reaching a high in July, Bitcoin dropped below $115,000, signaling a temporary disconnect between on-chain technical health and investor sentiment.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoAnalysts suggest this inconsistency is due to macroeconomic challenges, trade policies, and changing Capital flows. Meanwhile, Miners seem to be ahead of the rest of the market.

The combination of increasing difficulty, rising profit margins, and strong regional demand could mark a turning point in Bitcoin mining economics and the broader market cycle. If history repeats, the network's growing strength may soon be reflected in price.