Ethereum returns with DeFi again, with Aave/Pendle/Ethena turning circular lending into a leverage amplifier. Compared to the DeFi Summer's on-chain stack based on ETH, the leverage rise curve supported by stablecoins like USDe is more gradual.

We might be entering a warm long cycle, and the examination of on-chain protocols will be divided into two parts: first, involving more asset types, with external fund liquidity being more abundant under the Federal Reserve's rate cut expectations; second, exploring the limit of leverage multiples, corresponding to a safe deleveraging process, i.e., how individuals can safely exit and how the bull market will end.

This article focuses on on-chain protocol interactions, and external fund examination can be referenced in the previous article: New Changes in Crypto Power Structure: Anchorage's Iron Vault

Six Crypto Protocols: Ecosystem and Token Interactions

On-chain protocols and assets are numerous, but under the 80/20 rule, we only need to focus on parameters like TVL/trading volume/token price. More specifically, focus on the least number of essential entities in the on-chain ecosystem, and examine their relationships in the ecosystem network, balancing individual importance, ecosystem connectivity, and growth potential of new protocols.

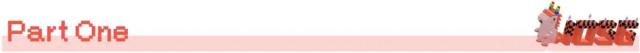

Image description: DeFi TVL Overview Image source: @zuoyeweb3

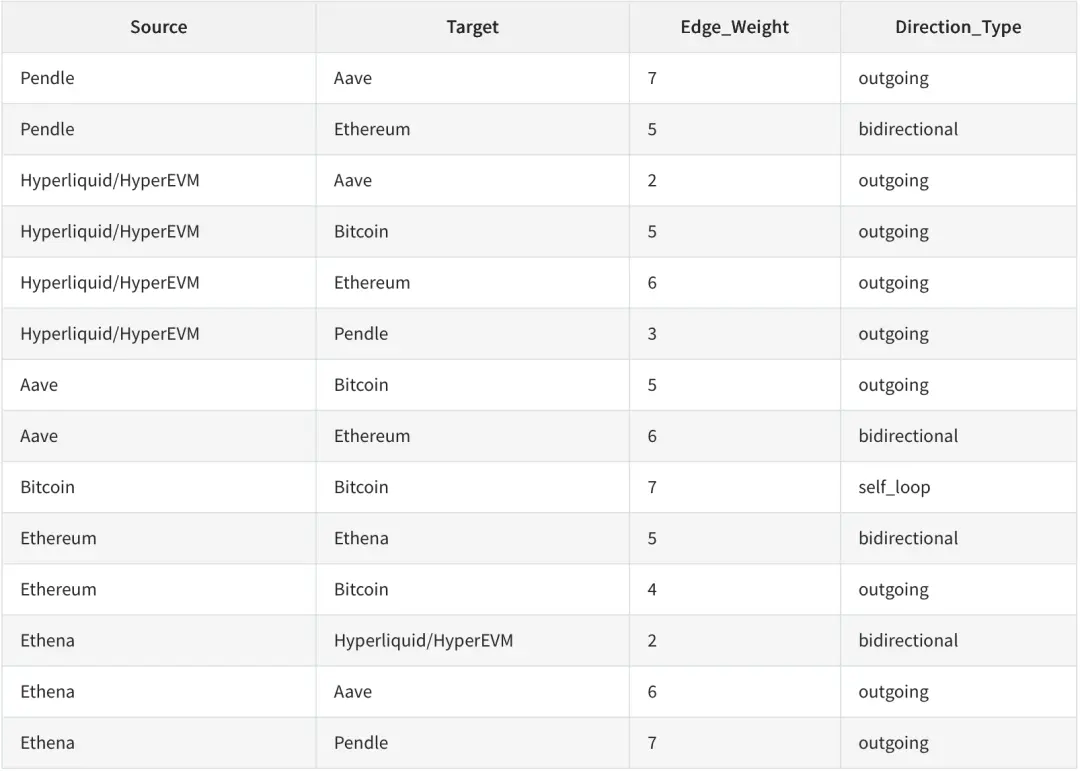

In the DeFi TVL composition, Ethereum's DeFi TVL share exceeded 60% in July, and Aave's share in the Ethereum ecosystem was also over 60%, which is the 20% in the 80/20 rule. The remaining protocols must have strong connections with these two to be included in the list of main passive beneficiaries.

With the flywheel of circular lending starting, the correlation between Ethereum, Aave, Pendle, and Ethena is self-evident. Adding Bitcoin, WBTC, ETH, and USDT/USDC are de facto DeFi base assets. However, USDT/USDC, similar to Lido, only possess asset attributes and basically lack ecosystem value, with Plasma, Stablechain just beginning to compete.

To make a slight distinction, a protocol can have multiple values. For example, Bitcoin basically only has asset value - everyone needs BTC, but no one knows how to utilize the Bitcoin ecosystem. Not saying BTCFi is a scam (dog head for protection).

ETH/Ethereum, however, has dual value - everyone needs both ETH and the Ethereum network, including EVM and its extensive DeFi stack and development facilities.

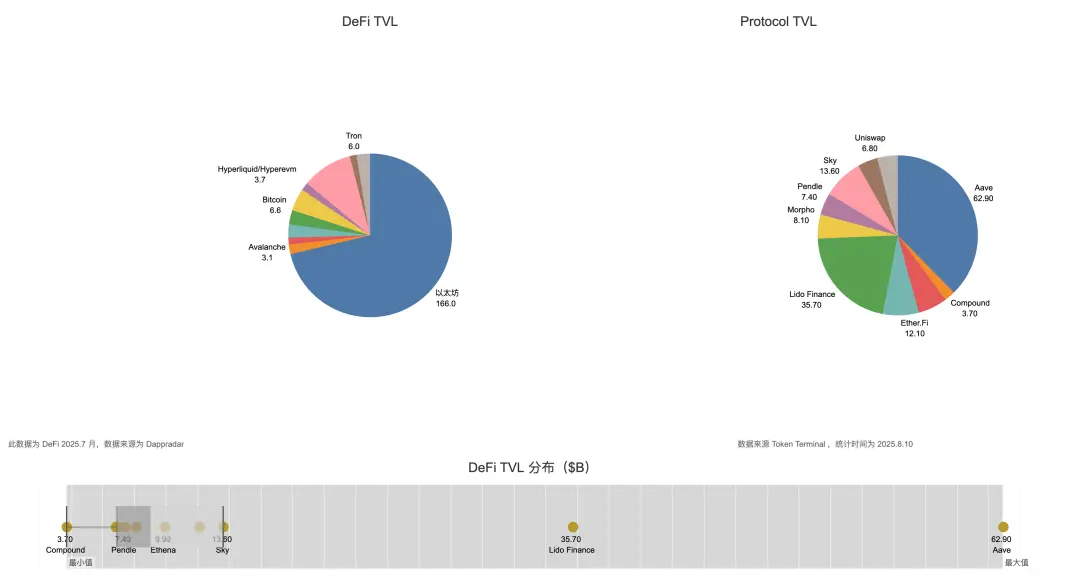

Further divided by asset and ecosystem value, examining the "being needed" degree of top protocols, gaining one point for asset attribute needed and one point for ecosystem value needed, the following table can be summarized:

Pendle/Aave/Ethena/Ethereum/HyperEVM/Bitcoin are the most strongly linked six protocols, with any two able to couple with each other, requiring at most an additional protocol or asset to link.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]• Ethena builds the third pole of stablecoins from $ENA and $USDe, $USDtb through DeFi circular lending and treasury strategies, while USDT/USDC's basic uses remain trading and payment, and USDe aims to become a risk-free asset in the DeFi field

• Aave is already the de facto lending infrastructure, closely tied to Ethereum

• Bitcoin and Ethereum represent the limits of the blockchain economic system, and their expansion is the basis for DeFi growth, that is, how much of BTC's scale can be migrated to DeFi, and how much room for growth DeFi still has

• Hyperliquid/HyperEVM is already closely integrated with existing DeFi giants, and although its TVL is far inferior to Solana, its growth prospects are larger, with Solana's story being to defeat the EVM system from a public chain perspective

Conclusion

The crypto six protocols examine the degree of interconnection, not implying that other protocols lack value, but that high collaborative proximity can exponentially improve fund freedom and utilization, thus benefiting all.

Of course, a loss would also be shared, which requires examining the subsequent development of DeFi anchor switching - from ETH to YBS, with ETH being a high-value asset more aggressive in leverage, while YBS like USDe is naturally more price-stable (not value-stable), and DeFi Lego based on it is more solid, theoretically allowing leverage and deleveraging curves to be more moderate, except in extreme de-anchoring situations.

Seats in the crypto pantheon are limited, and new chosen ones can only strive forward, make connections with existing deities, and build the strongest protocol network to earn their place.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Community:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush