Written by: Tanay Ved

Translated by: Saoirse, Foresight News

Key Points

Digital asset reserves focused on Ethereum are rapidly expanding, accumulating 2.2 million ETH in just two months (1.8% of total supply), causing a supply-demand imbalance.

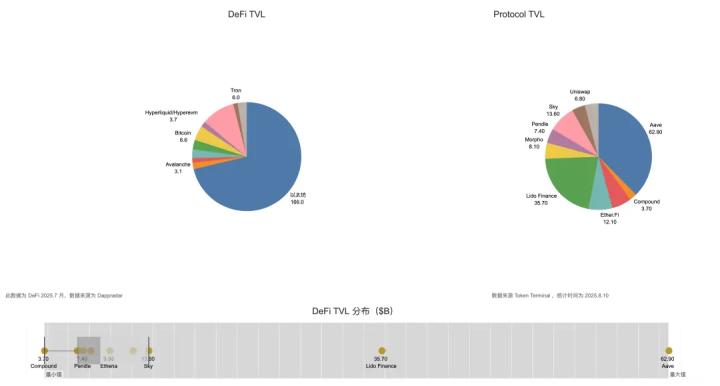

These treasuries are adopting active on-chain strategies, planning to allocate funds through staking and DeFi to increase yields while supporting network security and liquidity.

Despite currently being in the accumulation phase, higher on-chain participation may enhance Ethereum's liquidity and security while increasing its exposure to corporate capital risks.

The Rise of Digital Asset Reserves

Digital Asset Treasuries (DATs), which are listed companies holding crypto assets like Bitcoin or Ethereum on their balance sheets, have become a new market entry channel. The launch of spot ETFs in 2024 has released demand from investors who previously could not directly custody BTC and ETH. Similarly, digital asset reserves provide investors with an opportunity to access these assets and their ecosystems through publicly traded stocks, with the ability to strategically raise and allocate funds.

[Rest of the translation follows the same professional and accurate approach]

Linking Corporate Treasury Performance with On-Chain Health Status

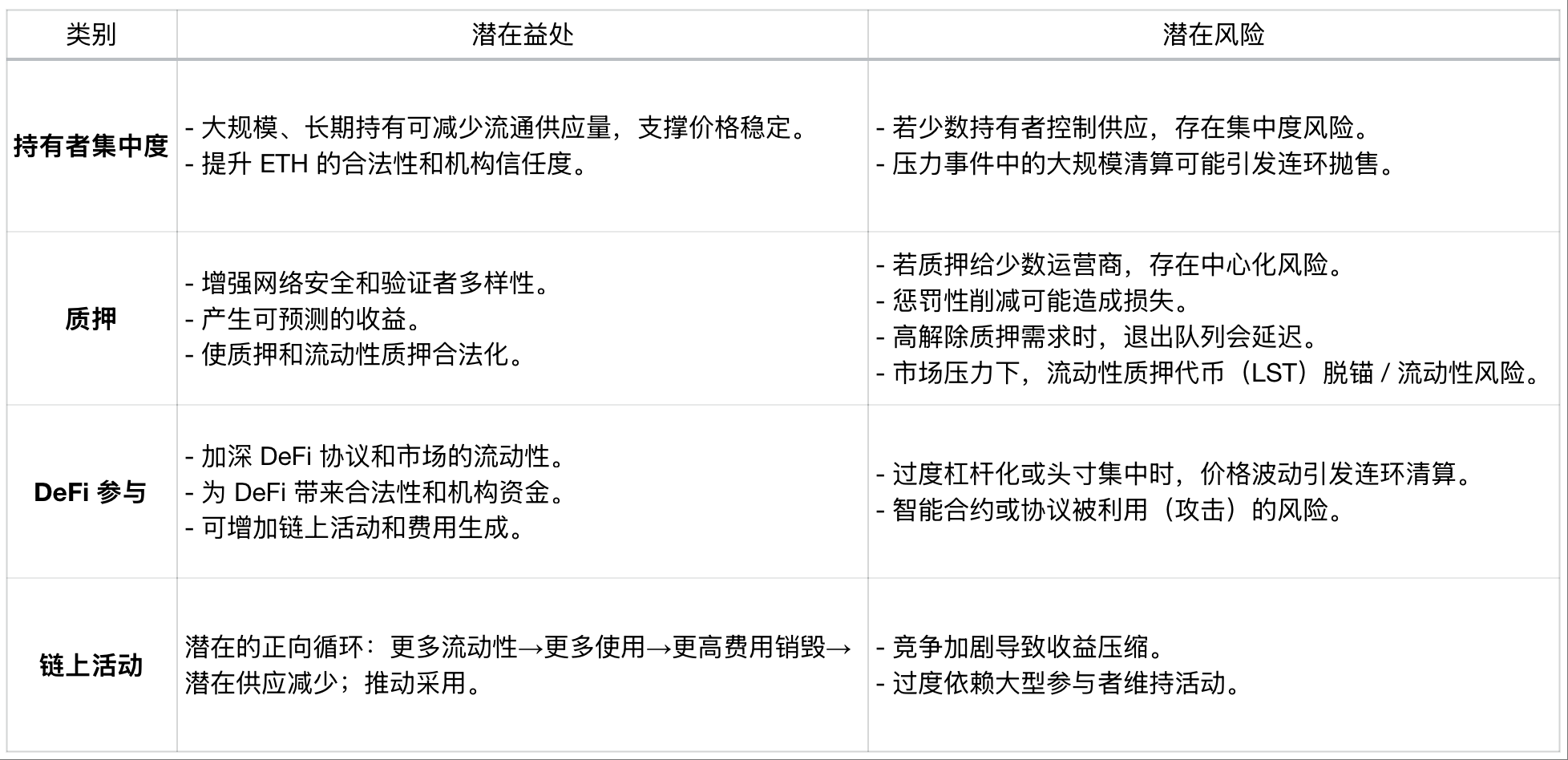

As the on-chain layout of listed Ethereum treasury companies continues to expand, their financial performance increasingly impacts the long-term network health of Ethereum, connecting off-chain corporate performance with potential on-chain influences. Large-scale long-term holdings can reduce circulating supply, enhance credibility, and increase on-chain liquidity, but centralization, leverage, and operational risks mean that enterprise-level issues may be transmitted to the network.

Impact of Large ETH Reserve Holdings on the Chain

Although these are network-level considerations, corporate treasuries themselves are also influenced by market forces and investor sentiment. Strong balance sheets and continuous investor confidence can expand reserve holdings and increase participation. Conversely, significant drops in underlying asset prices, tightened liquidity, or over-leveraging could lead to ETH selling or reduced on-chain activity.

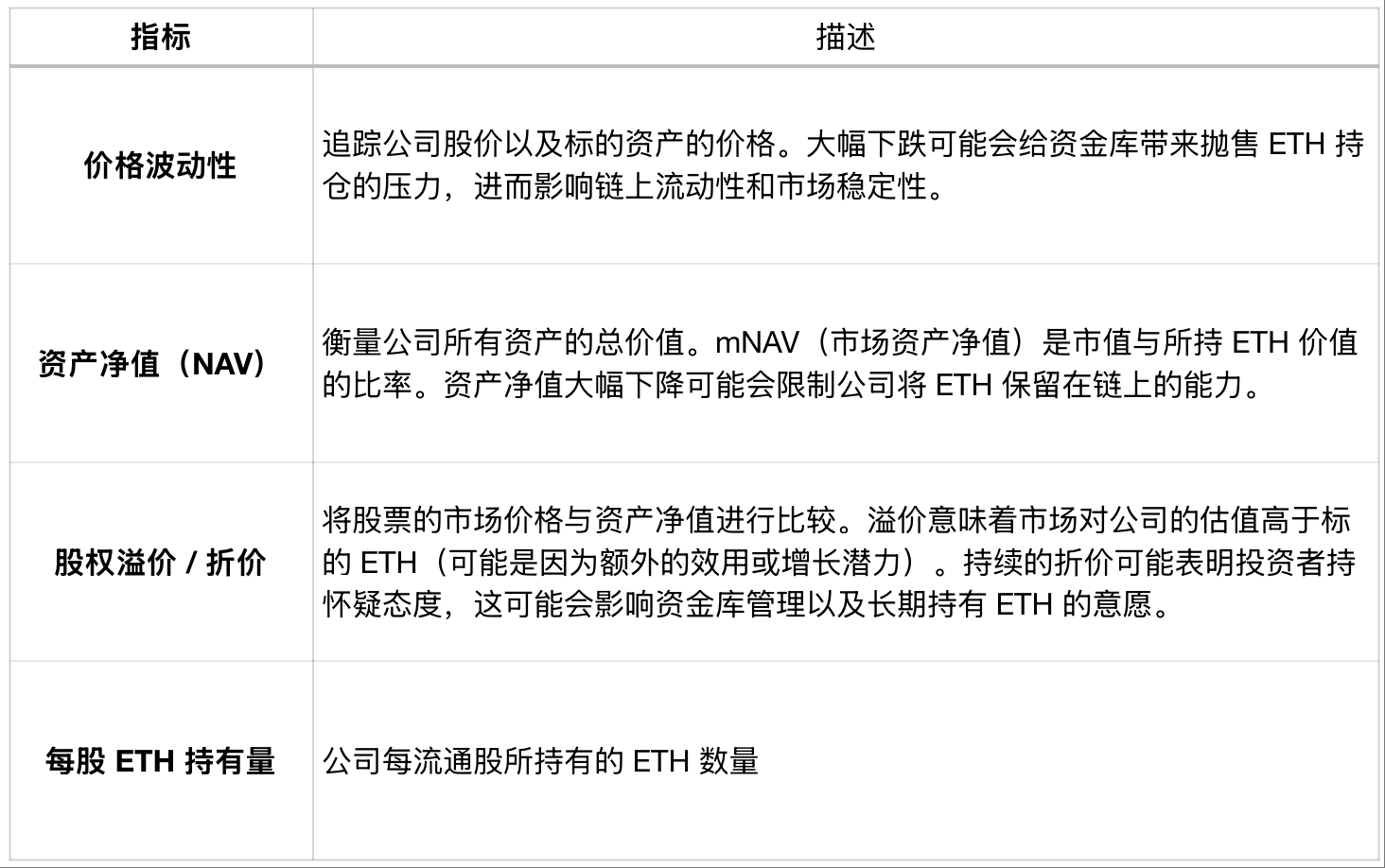

Indicators Related to Treasury Company Performance

The indicators track price volatility of company stock and underlying assets. Significant drops may pressure treasuries to sell ETH holdings, thereby affecting on-chain liquidity and market stability. Net Asset Value (NAV) measures the total value of all company assets. mNAV (market Net Asset Value) is the ratio of market capitalization to held ETH value. A substantial NAV decline may limit the company's ability to retain ETH on-chain. Stock premium/discount compares the market price of stock to its asset value. A premium means the market values the company higher than the underlying ETH (possibly due to additional utility or growth potential). Persistent discounts may indicate investor skepticism, which could affect treasury management and willingness to hold ETH long-term. ETH per Share represents the amount of ETH held per circulating share.

By tracking network-level impacts and the financial health of these companies, market participants can better predict how corporate treasury behavior might influence Ethereum's supply dynamics and overall network health.

Conclusion

The rapid rise of corporate Ethereum treasuries reflects Ethereum's attractiveness as a reserve asset and on-chain yield source. Its growing influence may increase liquidity and active network activity, but also comes with risks related to leverage, financing, and capital management. As off-chain factors (such as stock performance and debt repayment) become more closely linked with on-chain activities, these factors may quickly impact the on-chain environment. As these institutions expand in scale, tracking their balance sheet health and on-chain activity will be key to understanding their impact.