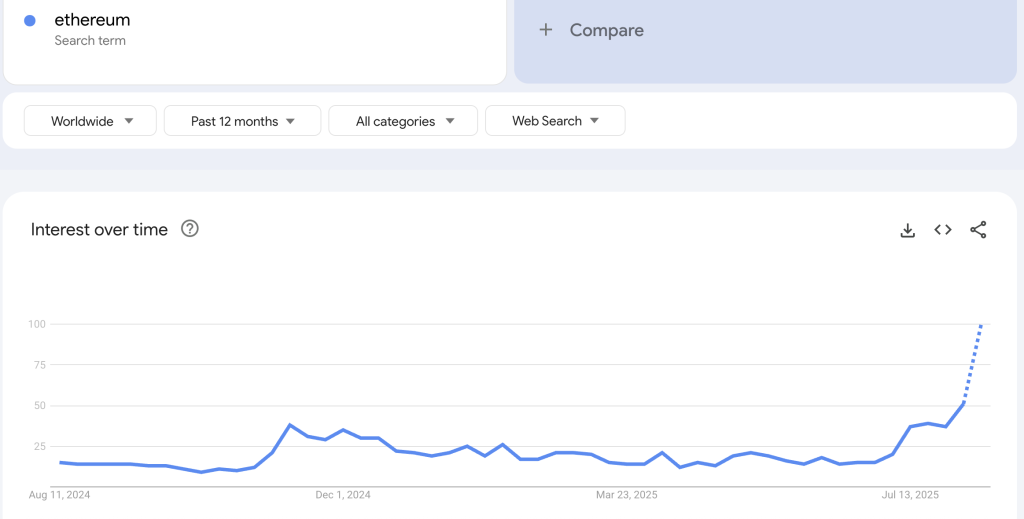

Retail interest in Ethereum just hit a three-year fever pitch—Google searches for ETH have spiked to levels not seen since the last bull market frenzy.

Why the sudden surge? The smart contract giant is knocking on the door of its all-time high price, waking up both crypto degens and traditional finance skeptics. When ETH starts mooning, even your CFA-obsessed uncle starts asking about gas fees.

This isn't just another crypto pump. The search spike suggests mainstream attention is returning—right as institutional players finally stop pretending they 'don't understand the use case' for decentralized apps.

Will history repeat? The last time searches peaked like this, ETH corrected hard shortly after. But with spot ETFs now live and staking yields still juicy, this rally might have longer legs than Wall Street's overpriced 'AI' stocks.

Source: Google Trends

Source: Google Trends

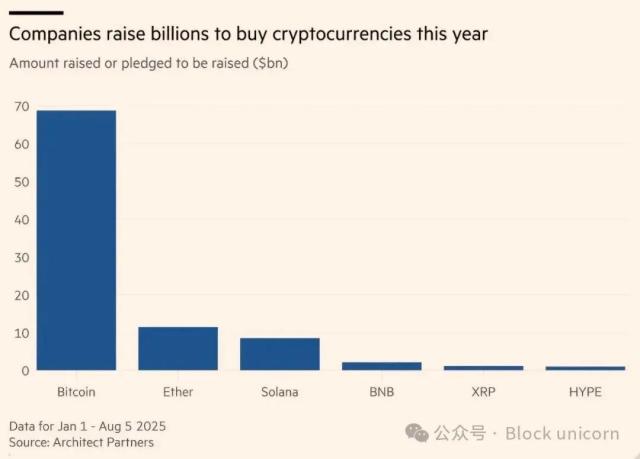

Institutional Demand Pushes ETH Higher as Treasuries Grow to $16.4B

This rise in attention coincides with an 8% jump in Ether’s price in a single day, propelled by mounting demand from institutional investors and corporate treasuries. Figures from strategicethreserve.xyz show Ethereum-focused treasuries now hold $16.4b worth of ETH.

At the same time, Ethereum’s network activity has reached an all-time record, with daily transactions hitting about 1.875m, according to CryptoQuant.

Ethereum Approaching Price ATH While Transaction Count Hits Record High

“Ethereum’s network activity has surged to unprecedented levels, with daily transactions reaching an all-time high of approximately 1.875 million.” – By @CryptoOnchain pic.twitter.com/IdZkVHAdTZ

Jamie Elkaleh, chief marketing officer at Bitget Wallet, said more companies are integrating ethereum into their treasuries as a strategic financial tool, not just a speculative bet. By staking ETH, firms can earn passive returns while supporting the network’s security, he said.

However, co-founder Vitalik Buterin has cautioned that overleveraging these holdings could destabilize the ecosystem if forced liquidations occur.

BlackRock, Fidelity Lead Record-Breaking ETH ETF Inflows

Ryan Lee, chief analyst at Bitget, noted that spot Ethereum ETF inflows exceeded $1b on August 11, led by BlackRock’s ETHA and Fidelity’s FETH. He attributed the inflows to Ethereum’s growing role in DeFi and Web3, and to improved macro sentiment following softer US inflation data.

Lee also pointed to the potential long-term impact of President Trump’s executive order allowing cryptocurrencies in 401(k) plans. Such policy changes, combined with ETF momentum and corporate accumulation, could expand crypto’s role in mainstream investment portfolios, he said.

Piyush Walke, derivatives research analyst at Delta Exchange, noted Ethereum has significantly outperformed Bitcoin in recent weeks, gaining 25% in August versus Bitcoin’s 3% rise.

Walke credited the rally to strong institutional inflows, technical breakouts and Optimism surrounding Ether ETFs. Monday marked the highest ever daily net inflows for spot Ether ETFs at $1.01b, coinciding with a 90% price gain over the last 40 days, he noted.

“Often seen as a bellwether for altcoins, Ethereum’s momentum could be an early signal of broader capital rotation into the wider altcoin market,” he added.

BitMine and SharpLink Drive Bullish Momentum With Major ETH Purchases

Institutions such as BitMine and SharpLink have sharply increased their ETH holdings, in some cases by several hundred percent. These purchases have reinforced bullish technical signals and driven prices through key resistance points.

Analysts say its current momentum could foreshadow capital rotation into other digital assets.

With search interest climbing and institutional engagement deepening, Ethereum’s approach to its all-time high is being watched closely by both retail traders and large investors.

Many will be looking to see if the current wave of demand can sustain the rally and potentially push the cryptocurrency to new records.